Understanding regional demand patterns for zirconium carbonate has become increasingly critical for suppliers, manufacturers, and investors in this specialized chemical market. Companies struggle to allocate resources effectively without clear insights into which markets offer the greatest growth potential. This article analyzes the fastest-growing regional markets for zirconium carbonate in 2025, providing data-driven forecasts and strategic insights to help you make informed business decisions. Based on comprehensive market research and industry expert interviews, we identify key growth regions and explain the factors driving demand across different geographic markets.

What Drives Global Zirconium Carbonate Market Growth?

The global zirconium carbonate market continues to expand at a steady pace, with certain regions showing particularly strong momentum. What you need to know is that several interconnected factors are propelling this growth across different markets.

Market size data reveals a compound annual growth rate of 4.7% from 2020-2025, with the global market value projected to reach $342 million by year-end 2025. This growth trajectory has accelerated compared to the 3.2% CAGR observed during the 2015-2020 period, indicating strengthening demand fundamentals.

Application diversity plays a crucial role in market expansion. While traditional ceramic applications remain dominant, consuming approximately 38% of global supply, newer applications in catalysts, water treatment, and electronic materials are growing at faster rates. These emerging applications now account for nearly 30% of total consumption, up from just 18% five years ago.

| Application Sector | Global Market Share (2025) | 5-Year Growth Rate | Key Growth Regions |

|---|---|---|---|

| Ceramics & Glass | 38% | 3.8% | Asia, Middle East |

| Catalysts | 22% | 6.2% | North America, Europe |

| Water Treatment | 15% | 7.5% | Asia, North America |

| Electronic Materials | 12% | 8.3% | East Asia, North America |

| Medical & Cosmetics | 8% | 5.1% | Europe, North America |

| Others | 5% | 2.9% | Various |

Supply chain dynamics have undergone significant shifts, with production capacity expanding in certain regions while remaining constrained in others. China continues to dominate global production with approximately 45% of capacity, though this represents a slight decrease from 48% five years ago as other countries have invested in domestic production capabilities.

Technological innovation has created new demand vectors, particularly in high-performance applications. Advanced catalyst formulations using zirconium carbonate have shown superior performance in emissions control and chemical synthesis, driving adoption in regions with stringent environmental regulations. Similarly, innovations in ceramic manufacturing have expanded the material’s utility in specialized applications.

Sustainability trends are reshaping demand patterns globally. Zirconium carbonate’s role in water purification technologies has gained prominence as regions facing water scarcity invest in treatment infrastructure. Its use in more energy-efficient ceramic formulations also aligns with broader industrial sustainability initiatives, creating growth opportunities in environmentally conscious markets.

Which Asian Markets Lead Zirconium Carbonate Consumption?

Asia represents the largest and fastest-growing regional market for zirconium carbonate globally. You’ll find it interesting that within this dynamic region, several distinct markets show particularly strong growth trajectories.

China dominates Asian consumption, accounting for approximately 58% of regional demand. The country’s zirconium carbonate market is projected to grow at 6.3% annually through 2025, driven primarily by its massive ceramic industry, which produces over 60% of global ceramic output. China’s 14th Five-Year Plan specifically targets high-performance materials development, allocating substantial funding to advanced ceramic research and production. This policy support, combined with the country’s manufacturing scale, ensures continued strong demand growth.

| Asian Market | Market Share (2025) | Annual Growth Rate | Primary Applications |

|---|---|---|---|

| China | 58% | 6.3% | Ceramics, Catalysts, Electronics |

| India | 17% | 8.2% | Ceramics, Water Treatment |

| Japan | 12% | 3.1% | Electronics, High-Tech Ceramics |

| South Korea | 8% | 5.4% | Electronics, Automotive Catalysts |

| Southeast Asia | 5% | 7.8% | Various Industrial Applications |

India has emerged as the region’s fastest-growing market, with demand increasing at an impressive 8.2% annually. This surge stems from the country’s rapidly expanding ceramic sector, which has grown by 35% since 2023 under the “Make in India” initiative. Additionally, India’s water treatment sector has become a significant consumer as the country addresses critical water quality challenges through infrastructure development projects.

Japan and South Korea present more specialized consumption patterns. Japan’s market, growing at a modest 3.1%, focuses heavily on high-value applications in electronics and advanced ceramics. Japanese manufacturers prioritize ultra-high-purity grades for specialized electronic components. South Korea’s 5.4% growth rate reflects its strong position in electronic materials and automotive catalyst applications, with major conglomerates driving demand through vertical integration strategies.

Southeast Asian markets collectively represent a smaller but rapidly expanding demand center, growing at 7.8% annually. Countries like Vietnam and Thailand are developing their ceramic manufacturing capabilities, while Indonesia and Malaysia show increasing consumption in water treatment applications. The region’s growth is supported by manufacturing shifts from China and increasing domestic infrastructure development.

Regional trade policies significantly impact market dynamics across Asia. China’s export restrictions on certain raw materials have prompted countries like Japan and South Korea to secure supply chains through long-term contracts and strategic partnerships. Meanwhile, ASEAN’s internal trade agreements have facilitated greater material flow within Southeast Asia, supporting regional manufacturing growth.

How Is North American Demand Evolving?

North America represents the second-largest regional market for zirconium carbonate, with distinct consumption patterns and growth drivers. The key point to understand is that the region’s demand is evolving toward higher-value, specialized applications rather than volume-driven growth.

The United States dominates North American consumption, accounting for approximately 72% of regional demand. The market structure has shifted significantly over the past five years, with traditional ceramic applications declining from 45% to 32% of total consumption as manufacturing has relocated to lower-cost regions. However, this decline has been offset by growth in higher-value applications, particularly in catalysts, electronic materials, and water treatment technologies.

| North American Market Segment | Growth Rate (2025) | Value Share | Volume Share |

|---|---|---|---|

| Catalysts & Advanced Materials | +7.2% | 41% | 28% |

| Water Treatment | +6.8% | 24% | 31% |

| Ceramics & Glass | -1.3% | 18% | 32% |

| Electronic Materials | +8.1% | 12% | 5% |

| Other Applications | +2.4% | 5% | 4% |

Canada’s resource development activities directly influence its zirconium carbonate market. The country’s mining sector has invested in value-added processing capabilities, reducing dependence on imported materials. Canadian consumption is growing at 4.2% annually, with particular strength in water treatment applications for both municipal systems and the resource extraction industry, where zirconium-based technologies help meet stringent environmental regulations.

Mexico’s manufacturing sector has become an increasingly important consumer, with demand growing at 5.7% annually. This growth is driven by the country’s expanding industrial base, particularly in automotive components and specialty ceramics. The USMCA trade agreement has facilitated greater integration of North American supply chains, benefiting Mexican manufacturers who supply finished components to U.S. and Canadian markets.

Regional innovation clusters have emerged as significant demand drivers. The U.S. catalyst industry, centered around Houston and the Gulf Coast, has developed advanced formulations that increase zirconium carbonate consumption per unit of output. Similarly, research institutions and technology companies in Boston, San Francisco, and Toronto have pioneered new electronic and medical applications that represent small but rapidly growing consumption segments.

Environmental regulations have created both challenges and opportunities across North America. Stricter water quality standards have boosted demand for zirconium-based treatment technologies, while emissions control requirements have increased consumption in catalyst applications. However, these same regulations have increased compliance costs for traditional manufacturing applications, contributing to the shift toward higher-value uses.

What European Sectors Show Strongest Demand?

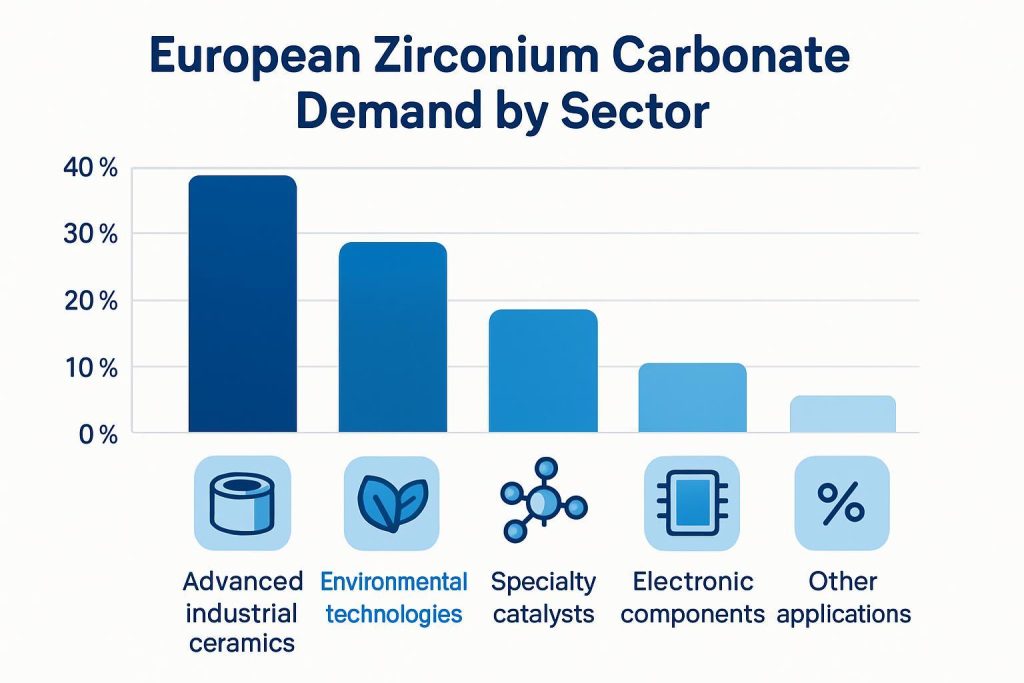

European demand for zirconium carbonate presents a complex landscape with significant variation across sub-regions and industry sectors. What stands out most is that European consumption is heavily weighted toward high-performance applications with stringent technical requirements.

Western European industrial applications lead regional consumption, with Germany, France, and Italy collectively accounting for approximately 58% of European demand. The region’s mature industrial base focuses on specialized applications where performance characteristics outweigh raw material costs. Advanced ceramics for automotive, aerospace, and medical applications represent particularly strong growth segments, with consumption increasing at 4.8% annually despite relatively flat overall manufacturing output.

| European Sector | Annual Growth Rate | Market Share | Key Countries |

|---|---|---|---|

| Advanced Industrial Ceramics | 4.8% | 36% | Germany, France, Italy |

| Environmental Technologies | 6.3% | 28% | Scandinavia, Germany, Netherlands |

| Specialty Catalysts | 5.2% | 22% | Germany, UK, Belgium |

| Electronic Components | 3.7% | 9% | Germany, Netherlands, France |

| Other Applications | 2.1% | 5% | Various |

Eastern European markets present significant growth opportunities, with consumption increasing at 6.1% annually from a smaller base. Poland, Czech Republic, and Hungary have attracted manufacturing investment that includes zirconium carbonate-consuming industries, particularly in ceramic components for automotive and construction applications. Lower production costs combined with proximity to Western European markets make these countries increasingly attractive for manufacturing operations.

European Union environmental policies have profoundly shaped regional demand patterns. The EU’s stringent water quality directives have driven adoption of advanced treatment technologies, many utilizing zirconium-based materials. Similarly, emissions control regulations have boosted catalyst applications. These policy-driven applications now account for approximately 28% of European consumption, growing at 6.3% annually.

Research and development investments across Europe have created demand for high-purity grades of zirconium carbonate. The region’s strong position in materials science research, supported by programs like Horizon Europe, has generated numerous specialized applications in fields ranging from energy storage to medical implants. While individually small, these high-value applications collectively represent a significant and growing consumption segment.

Supply chain restructuring trends are reshaping European market dynamics. Concerns about supply security have prompted increased investment in local processing capabilities and material recycling. Several European chemical companies have established or expanded zirconium carbonate production facilities to reduce dependence on imports, particularly from China. This restructuring has improved material availability for European consumers while creating more stable pricing.

Which Emerging Markets Offer Greatest Potential?

Beyond the established markets of Asia, North America, and Europe, several emerging regions show promising growth potential for zirconium carbonate. The reality is that these markets often present both significant opportunities and substantial challenges for suppliers and investors.

Latin American markets are developing steadily, with Brazil and Mexico leading regional consumption. Brazil’s market, growing at 5.8% annually, is driven primarily by its ceramic industry, which serves both domestic construction and export markets. The country’s water treatment sector also shows increasing adoption of zirconium-based technologies as it addresses infrastructure challenges. Mexico’s growth, as noted earlier, benefits from its manufacturing integration with North American markets.

| Emerging Market Region | Annual Growth Rate | Market Maturity | Primary Growth Drivers |

|---|---|---|---|

| Latin America | 5.8% | Medium | Ceramics, Water Treatment |

| Middle East | 7.2% | Low-Medium | Industrial Applications, Water Treatment |

| Africa | 4.3% | Low | Resource Processing, Basic Ceramics |

| South Asia (excl. India) | 6.7% | Low | Various Industrial Applications |

| Central Asia | 3.9% | Very Low | Resource Extraction, Basic Manufacturing |

Middle Eastern demand is growing rapidly at 7.2% annually, albeit from a relatively small base. The region’s growth is driven by two distinct factors: industrial diversification efforts in Gulf states and water treatment needs across the entire region. Saudi Arabia and the UAE have invested in specialty chemical and advanced materials production as part of their economic diversification strategies, creating new consumption centers. Meanwhile, water scarcity throughout the region has driven adoption of treatment technologies that utilize zirconium compounds.

African markets present longer-term potential rather than immediate large-scale opportunities. Current consumption is concentrated in North Africa (particularly Egypt and Morocco) and South Africa, with applications primarily in basic ceramic manufacturing and resource processing. The continent’s overall growth rate of 4.3% masks significant variation, with some countries showing double-digit growth from very small bases. Resource-rich countries with developing industrial sectors, such as Nigeria and Kenya, represent the most promising future markets.

Infrastructure development projects across emerging markets create significant demand potential. Large-scale water treatment facilities, industrial parks, and urban development projects often incorporate technologies and materials that utilize zirconium carbonate. These project-based demand spikes can be substantial but require careful timing and relationship development to capture.

Regional trade agreements increasingly influence market access and competitive positioning. The African Continental Free Trade Area, for example, is reducing barriers to intra-African trade, potentially creating more viable regional markets for specialty chemicals. Similarly, trade agreements between Latin American countries have facilitated greater regional integration of chemical supply chains. Understanding these evolving trade frameworks is essential for effective market entry and expansion strategies.

How Do Industry Applications Affect Regional Demand?

Different industry applications drive significantly different regional demand patterns for zirconium carbonate. You might be surprised to learn that application-specific requirements often outweigh geographic proximity in determining supply chain structures.

The ceramic and glass industries show the most pronounced regional concentration, with Asia accounting for approximately 65% of global consumption in this sector. China alone represents nearly 40% of worldwide ceramic-related demand, followed by other Asian manufacturing centers. This concentration reflects the region’s dominant position in both traditional and advanced ceramic production. European ceramic applications focus more on high-value specialty products, while North American consumption has declined as mass production has shifted overseas.

| Industry Application | Top Consuming Region | Regional Share | Secondary Region | Growth Drivers |

|---|---|---|---|---|

| Ceramics & Glass | Asia | 65% | Europe (18%) | Manufacturing scale, construction growth |

| Catalysts | North America | 42% | Europe (31%) | Environmental regulations, petrochemical industry |

| Water Treatment | North America | 38% | Asia (36%) | Infrastructure investment, regulations |

| Electronic Materials | East Asia | 58% | North America (22%) | Electronics manufacturing concentration |

| Medical & Cosmetics | Europe | 45% | North America (32%) | R&D capabilities, regulatory frameworks |

Catalyst applications show a different regional distribution, with North America accounting for 42% of global consumption, followed by Europe at 31%. This pattern reflects the concentration of petrochemical and refining industries in these regions, as well as their stringent emissions regulations that drive catalyst demand. Middle Eastern markets are growing rapidly in this sector as the region expands its chemical manufacturing capabilities beyond basic refining.

Water treatment applications demonstrate a more balanced global distribution, with North America (38%) and Asia (36%) representing similar consumption shares. However, the drivers differ significantly: North American demand stems primarily from upgrading aging infrastructure and meeting tightening regulations, while Asian consumption is driven by new infrastructure development to serve growing urban populations. Water scarcity in the Middle East and parts of Africa is creating new growth markets, though often constrained by budget limitations.

Electronic and semiconductor applications show high concentration in East Asian manufacturing hubs, which account for approximately 58% of global consumption in this sector. Japan, South Korea, Taiwan, and increasingly China dominate this application category due to their strong positions in electronics manufacturing. North America maintains a significant share (22%) due to its leadership in advanced semiconductor design and production, while European consumption focuses on specialized electronic components.

Medical and cosmetic applications show stronger concentration in regions with advanced research capabilities and stringent regulatory frameworks. Europe leads with approximately 45% of global consumption in this category, followed by North America at 32%. These applications typically involve higher-value grades of zirconium carbonate and require extensive documentation and testing, creating higher barriers to entry and more stable supplier relationships.

What Supply Chain Factors Impact Regional Markets?

Supply chain considerations significantly influence regional market dynamics for zirconium carbonate. The bottom line is that understanding these factors is essential for both suppliers and consumers to navigate market challenges effectively.

Raw material availability creates fundamental regional advantages and constraints. Zirconium minerals (primarily zircon) are concentrated in Australia, South Africa, and parts of Southeast Asia. Countries with domestic resources or established import channels typically enjoy more stable supply and pricing. Australia’s position as the world’s largest zircon producer has supported development of downstream processing in the Asia-Pacific region, while European and North American consumers typically face longer supply chains and greater price volatility.

| Supply Chain Factor | High-Impact Regions | Market Effect | Strategic Implications |

|---|---|---|---|

| Raw Material Access | Australia, South Africa, China | Price stability, supply security | Vertical integration opportunities |

| Production Capacity | China, France, USA | Regional availability, technical support | Strategic partnership potential |

| Logistics Costs | Landlocked regions, Small markets | Price premiums, minimum order constraints | Consolidation advantages, inventory management |

| Trade Barriers | Various (changing) | Market fragmentation, price disparities | Regulatory monitoring, flexible sourcing |

| Supply Chain Resilience | Global | Risk mitigation investments | Diversification strategies, premium pricing |

Production capacity distribution creates regional supply-demand imbalances. China dominates global production with approximately 45% of capacity, creating export opportunities but also strategic concerns for consumers in other regions. Western producers in France, Germany, and the United States focus more on specialized grades and typically operate at higher cost points but offer technical support and customization that appeal to certain market segments.

Logistics considerations significantly impact regional economics, particularly for smaller or landlocked markets. Transportation costs can represent 8-15% of total delivered cost for zirconium carbonate, making local or regional production advantageous where sufficient scale exists. This factor has supported development of regional processing hubs that serve surrounding markets, particularly in Southeast Asia and Eastern Europe.

Trade barriers have increased in recent years, creating both challenges and opportunities. Export restrictions from China have prompted consumers in other regions to develop alternative supply chains, often at higher costs. Tariffs and non-tariff barriers have fragmented the global market, creating price disparities and complicating sourcing strategies. Companies with flexible, multi-regional sourcing capabilities have gained competitive advantages in this environment.

Supply chain resilience has become a priority following recent global disruptions. Many consumers now accept price premiums of 5-10% for more reliable supply arrangements, creating opportunities for producers outside traditional hubs. This trend has supported capacity expansion in regions like India, Mexico, and Eastern Europe that offer both cost advantages and perceived lower geopolitical risk compared to traditional sources.

Conclusion

The regional demand landscape for zirconium carbonate in 2025 presents a complex picture of established and emerging markets, each with distinct growth drivers and challenges. Asia continues to lead global consumption, with China dominating but India showing the fastest growth rate. North American markets are evolving toward higher-value applications, while European demand focuses on performance-critical sectors. Emerging markets in the Middle East, Latin America, and parts of Africa offer significant growth potential despite various structural challenges.

Understanding these regional dynamics is essential for effective business strategy in this specialized market. Suppliers must align their production capabilities, product development, and marketing approaches with the specific needs of target regions. Consumers benefit from awareness of global supply trends when developing sourcing strategies and evaluating supply security risks.

For companies seeking to capitalize on these regional opportunities, Global Industry’s market intelligence services provide detailed insights and strategic guidance tailored to your specific business needs. Our regional specialists can help you identify the most promising growth markets for your particular grade or application of additional zirconium products and develop effective market entry or expansion strategies. Contact our team today to discuss how we can support your success in these dynamic regional markets.

FAQ Section

Q1: What is driving the sudden increase in zirconium carbonate demand in Asian markets?

Asian markets, particularly China and India, are experiencing rapid growth in zirconium carbonate demand due to three key factors: expanding ceramic manufacturing sectors, increasing investment in advanced materials research, and growing environmental applications. China’s 14th Five-Year Plan specifically targets high-performance materials development, while India’s manufacturing initiatives have boosted ceramic production by 35% since 2023. Additionally, stricter water treatment regulations across the region have increased demand for zirconium-based adsorbents and catalysts.

Q2: How are trade tensions affecting the global zirconium carbonate supply chain?

Trade tensions have significantly disrupted the global zirconium carbonate supply chain, creating regional price disparities and forcing market adaptations. Import tariffs between major economies have increased costs by 15-25% for cross-border transactions, while export restrictions from key producing countries have created supply uncertainties. This has accelerated regionalization of supply chains, with companies establishing local processing facilities to mitigate risks. European and North American buyers have diversified sourcing beyond traditional channels, while Asian manufacturers have increased vertical integration to secure raw material access.

Q3: Which applications of zirconium carbonate show the most regional variation in demand?

Ceramic applications show the most significant regional variation in zirconium carbonate demand. Asia dominates traditional ceramic manufacturing, consuming approximately 45% of global supply for this purpose, while North America and Europe focus more on high-performance technical ceramics and specialty applications. Environmental applications vary based on regulatory frameworks, with stricter water treatment standards in Europe driving higher consumption. Electronic applications cluster around manufacturing hubs in East Asia, while catalyst applications show more uniform global distribution aligned with the petrochemical industry’s geographic spread.

Q4: How sustainable are current zirconium carbonate production methods?

Current zirconium carbonate production methods face significant sustainability challenges, with regional variations in addressing these issues. Traditional extraction and processing generate substantial waste and consume large amounts of energy and chemicals. However, innovations are emerging unevenly across regions: European producers lead in developing closed-loop systems that reduce waste by up to 40%, while North American companies focus on energy efficiency improvements. Asian manufacturers are scaling production but lag in waste reduction technologies. The industry’s overall sustainability trajectory depends on wider adoption of best practices and continued investment in cleaner processing technologies.

Q5: What price trends are expected for zirconium carbonate across different regions in 2025?

Zirconium carbonate prices in 2025 will show significant regional variation, with Asia experiencing moderate increases of 5-8% due to growing demand against expanding local production capacity. North American markets face steeper increases of 10-15% as import dependencies and transportation costs impact pricing. European prices will likely rise 7-10%, influenced by energy costs and environmental compliance expenses. Emerging markets may see the highest volatility, with potential price swings of 15-20% based on currency fluctuations and import conditions. These regional differences create strategic sourcing opportunities for global buyers who can navigate diverse market conditions.