Choosing between zircon and zirconia powder can make or break your manufacturing budget and product performance. These two materials may sound similar, but their market dynamics, pricing structures, and applications differ significantly. This comprehensive analysis provides procurement professionals and manufacturing decision-makers with the data-driven insights needed to make informed sourcing decisions. Our research team has analyzed current market trends, pricing patterns, and supply chain dynamics to help you select the right material for your specific needs while optimizing costs and ensuring reliable supply.

What Are the Key Differences Between Zircon and Zirconia?

The fundamental distinction starts with chemistry. Zircon (ZrSiO4) is a naturally occurring mineral silicate, while zirconia (ZrO2) is a processed ceramic oxide derived from zircon ore. This chemical difference creates vastly different material properties and market positions.

Zircon powder maintains a hardness rating of 7.5 on the Mohs scale and offers excellent thermal shock resistance. Its melting point reaches 2,550°C, making it suitable for high-temperature applications. The material’s natural radioactivity levels vary depending on source location, which affects its suitability for certain applications.

Zirconia powder, conversely, achieves superior mechanical properties through controlled processing. Here’s where performance really matters: zirconia exhibits exceptional fracture toughness, reaching 6-15 MPa·m½ compared to zircon’s 2-3 MPa·m½. Its thermal conductivity remains low at 2-3 W/mK, while zircon conducts heat at 4-6 W/mK.

Manufacturing processes differ substantially between these materials. Zircon requires mechanical processing, including crushing, grinding, and classification. Zirconia production involves chemical processing, including precipitation, calcination, and often stabilization with yttria or other oxides.

| Property | Zircon (ZrSiO4) | Zirconia (ZrO2) |

|---|---|---|

| Hardness (Mohs) | 7.5 | 8.5-9 |

| Melting Point (°C) | 2,550 | 2,700 |

| Density (g/cm³) | 4.6-4.7 | 5.9-6.1 |

| Thermal Conductivity (W/mK) | 4-6 | 2-3 |

| Fracture Toughness (MPa·m½) | 2-3 | 6-15 |

Raw material availability creates another key difference. Zircon mining occurs primarily in Australia, South Africa, and Kenya, with limited global reserves. Zirconia production depends on zircon as feedstock but can utilize various processing routes and stabilizing additives.

How Do Production Costs Compare Between These Materials?

Cost structures reveal significant differences in manufacturing economics. Zircon powder production costs range from $800-1,200 per ton for standard grades, while zirconia powder costs typically span $2,000-4,500 per ton depending on purity and stabilization requirements.

Raw material costs dominate zircon pricing, representing 60-70% of total production expenses. Mining operations, transportation from remote locations, and beneficiation processes drive these costs. Energy requirements remain moderate, primarily for mechanical processing and drying operations.

Zirconia production involves higher processing complexity and energy consumption. The numbers tell the story: chemical processing requires 2-3 times more energy than mechanical beneficiation. Precipitation, calcination, and stabilization steps add significant costs, particularly for high-purity grades requiring multiple purification cycles.

Equipment investments differ substantially. Zircon processing utilizes standard mineral processing equipment: crushers, mills, classifiers, and magnetic separators. Capital requirements typically range from $5-15 million for a 50,000 ton/year facility.

Zirconia manufacturing requires specialized chemical processing equipment, including reactors, calciners, and spray dryers. Investment requirements jump dramatically: a 10,000 ton/year zirconia plant requires $25-50 million in capital investment.

| Cost Component | Zircon Powder | Zirconia Powder |

|---|---|---|

| Raw Materials | 60-70% | 40-50% |

| Energy | 10-15% | 25-30% |

| Labor | 8-12% | 10-15% |

| Equipment Depreciation | 5-8% | 15-20% |

| Quality Control | 3-5% | 5-8% |

Labor costs vary by production complexity. Zircon processing requires skilled operators for mineral processing equipment. Zirconia production demands chemical engineers and specialized technicians for process control and quality assurance.

Quality control expenses increase significantly for zirconia due to stringent purity requirements and phase composition analysis. Testing costs can reach $50-100 per ton for high-grade zirconia compared to $10-20 per ton for standard zircon.

Which Industries Drive Demand for Each Powder Type?

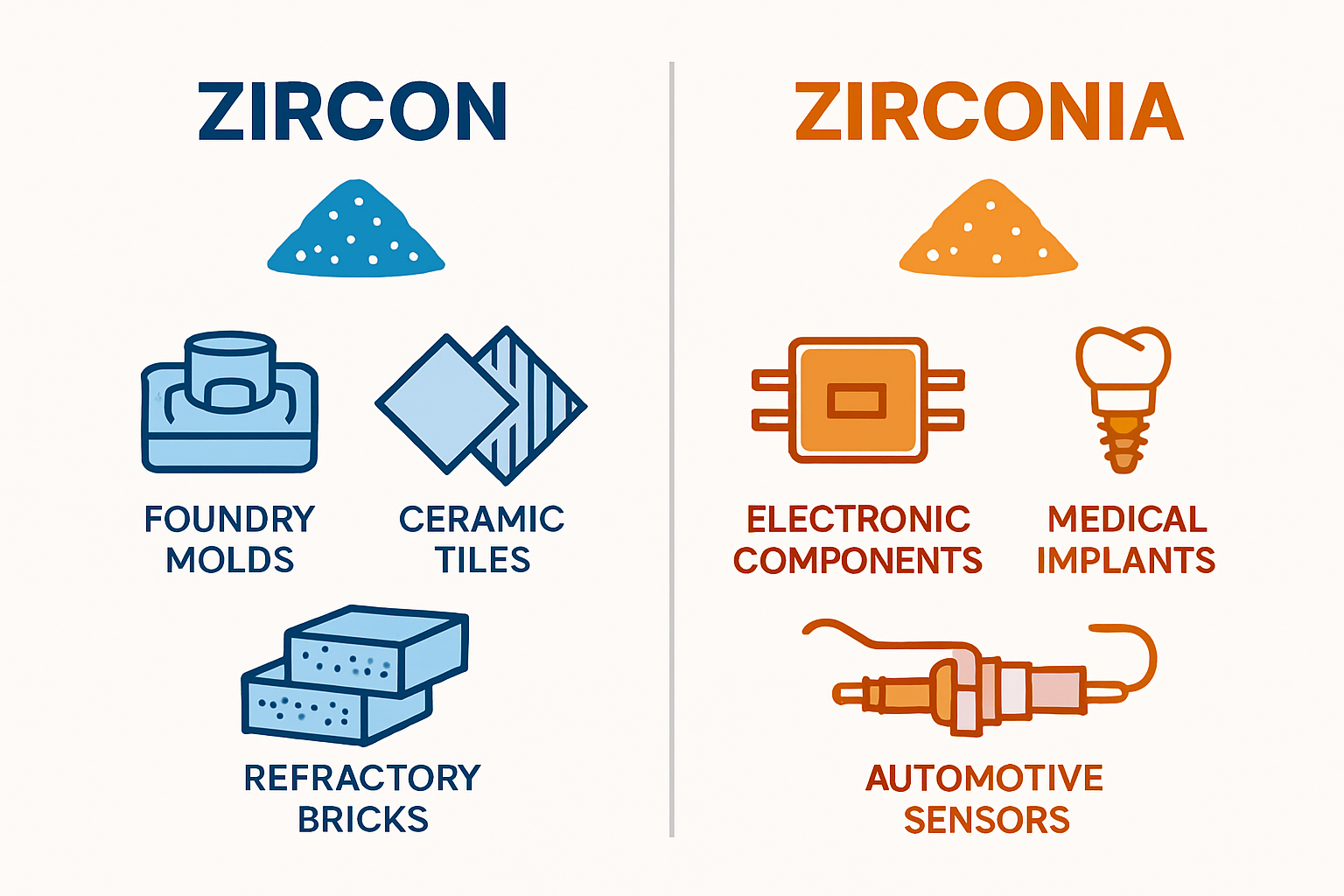

Market demand patterns show distinct industry preferences. Zircon powder serves primarily foundry applications (45%), ceramics manufacturing (30%), and refractory production (20%). The remaining 5% includes specialty applications like investment casting and abrasives.

Foundry applications dominate zircon consumption due to its excellent thermal properties and chemical inertness. Steel foundries use zircon sand for mold and core making, particularly for high-temperature casting operations. The automotive industry drives significant demand through engine block and transmission housing production.

Ceramic tile and sanitaryware manufacturing represents the second-largest zircon market segment. Here’s the key advantage: zircon’s opacity and whiteness make it valuable for ceramic glazes and bodies. Premium tile manufacturers pay premiums for low-iron zircon grades.

Zirconia powder serves different market segments with electronics (35%), medical devices (25%), automotive components (20%), and industrial ceramics (20%) leading demand. Electronics applications include capacitors, sensors, and fuel cell components where high dielectric properties matter.

Medical device manufacturing drives premium zirconia demand. Hip and knee implants require biocompatible, high-strength zirconia. The growth potential is substantial: aging populations worldwide increase orthopedic implant demand by 8-10% annually.

Automotive applications focus on oxygen sensors, catalytic converter components, and advanced engine parts. Electric vehicle growth creates new opportunities for zirconia in battery components and power electronics.

| Industry Segment | Zircon Demand (%) | Zirconia Demand (%) |

|---|---|---|

| Foundry | 45 | 5 |

| Ceramics | 30 | 20 |

| Electronics | 5 | 35 |

| Medical | 2 | 25 |

| Automotive | 8 | 20 |

| Refractories | 20 | 10 |

Market size comparisons show zircon’s larger volume but zirconia’s higher value. Global zircon consumption reaches approximately 1.5 million tons annually, valued at $1.8 billion. Zirconia markets consume 180,000 tons yearly but generate $2.2 billion in revenue.

Growth projections favor zirconia markets. Technology advancement drives this trend: electronics miniaturization, medical device innovation, and automotive electrification boost high-performance ceramic demand. Zirconia markets project 6-8% annual growth compared to 3-4% for zircon.

What Are the Current Market Pricing Trends?

Price volatility patterns differ significantly between these materials. Zircon prices experienced dramatic swings over the past decade, ranging from $1,200-2,800 per ton for premium grades. Supply disruptions, particularly from Australian operations, created price spikes in 2018-2019.

Current zircon pricing stabilized around $1,400-1,800 per ton for standard foundry grades and $1,800-2,200 per ton for ceramic-grade material. Market dynamics shifted recently: increased supply from new African operations and reduced Chinese demand moderated prices from 2022 peaks.

Zirconia pricing shows different patterns with less volatility but higher absolute levels. Standard 3% yttria-stabilized zirconia (3YSZ) trades at $3,200-4,200 per ton, while high-purity medical grades command $8,000-12,000 per ton.

Regional price variations reflect transportation costs and local market conditions. Asian markets typically show 5-10% premiums due to strong demand and logistics costs. European prices align closely with global benchmarks, while North American markets often trade at slight discounts due to proximity to end users.

| Grade Type | Current Price Range ($/ton) | 2023 Average ($/ton) |

|---|---|---|

| Zircon – Foundry | 1,400-1,800 | 1,580 |

| Zircon – Ceramic | 1,800-2,200 | 1,950 |

| Zirconia – 3YSZ | 3,200-4,200 | 3,650 |

| Zirconia – Medical | 8,000-12,000 | 9,800 |

Seasonal demand patterns affect pricing differently. Zircon shows moderate seasonality with Q2-Q3 strength driven by foundry activity. Zirconia markets exhibit less seasonal variation due to steady electronics and medical device production.

Price forecasting indicates continued divergence. Zircon prices may remain range-bound at $1,500-2,000 per ton through 2025, supported by supply discipline but limited by demand growth constraints. Zirconia prices face upward pressure from raw material costs and growing high-tech applications.

Currency fluctuations impact pricing significantly. Most transactions occur in US dollars, creating exposure for non-US buyers. Australian dollar strength affects zircon costs, while Chinese yuan movements influence zirconia processing costs.

How Do Supply Chain Dynamics Differ?

Geographic concentration creates distinct supply risks. Zircon supply depends heavily on three countries: Australia (37%), South Africa (31%), and Kenya (12%). This concentration makes markets vulnerable to operational disruptions, regulatory changes, and geopolitical tensions.

Australian operations, primarily Iluka Resources and Tronox, control significant market share through large-scale mineral sands operations. Supply security concerns arise: mine life limitations and environmental restrictions could constrain future production. New projects face lengthy approval processes and substantial capital requirements.

South African production offers supply diversification but faces infrastructure challenges and regulatory uncertainty. Mining operations in KwaZulu-Natal province provide high-quality zircon but depend on port facilities and transportation networks.

Zirconia supply chains show greater geographic diversity in processing locations. While raw zircon originates from the same concentrated sources, processing occurs globally. China dominates zirconia production (45%), followed by Japan (15%), Europe (12%), and North America (10%).

Transportation considerations differ substantially. Zircon ships as bulk commodity in standard containers or break-bulk vessels. Shipping costs typically range $50-150 per ton depending on origin-destination pairs and vessel availability.

Zirconia requires specialized packaging and handling due to higher value and contamination sensitivity. Logistics costs increase proportionally: air freight becomes economical for high-value grades, while standard grades ship in moisture-controlled containers.

| Supply Chain Factor | Zircon | Zirconia |

|---|---|---|

| Geographic Concentration | High (3 countries = 80%) | Medium (Processing distributed) |

| Lead Times | 4-8 weeks | 6-12 weeks |

| Minimum Order Quantities | 20-50 tons | 1-10 tons |

| Packaging Requirements | Bulk/containers | Specialized containers |

| Quality Variability | Moderate | Low |

Supply security strategies differ by material. Zircon buyers often maintain 2-3 month inventory levels due to supply concentration and longer lead times. Multiple supplier relationships become critical for risk mitigation.

Zirconia procurement focuses on quality consistency and technical support. Supplier relationships matter more: processing expertise, quality systems, and technical service capabilities often outweigh price considerations for critical applications.

Alternative sourcing strategies include recycling and substitution. Zircon recycling remains limited due to contamination issues in foundry applications. Zirconia recycling shows promise in electronics and medical applications where material purity can be maintained.

Which Material Offers Better Long-term Value?

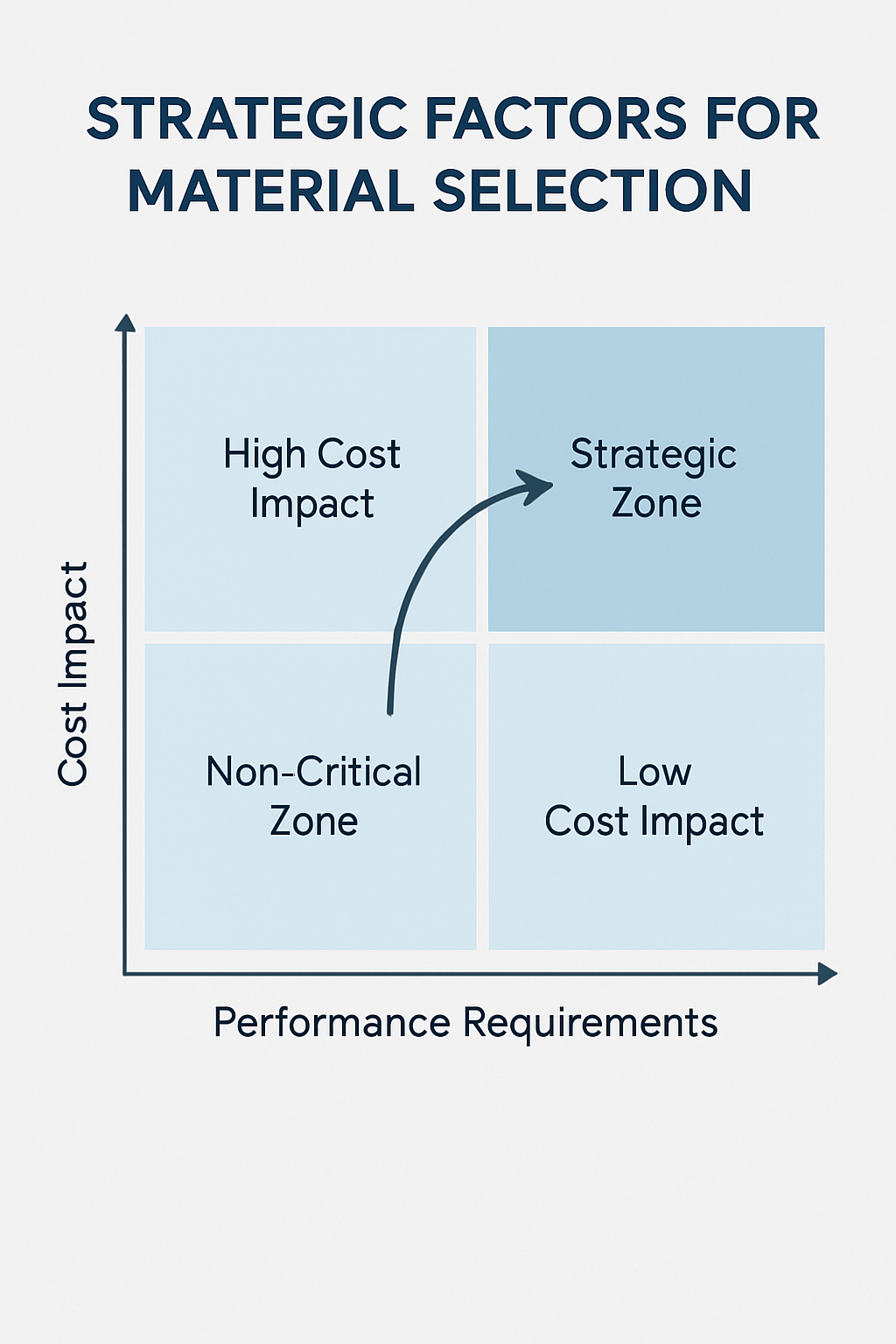

Total cost of ownership analysis reveals complex trade-offs. Zircon’s lower initial cost attracts price-sensitive applications, but performance limitations may increase total system costs. Zirconia’s premium pricing often justifies itself through superior performance and longer service life.

Performance benefits vary by application. In foundry operations, zircon’s thermal shock resistance and chemical inertness provide reliable performance at competitive costs. The value equation changes: high-volume, cost-sensitive applications favor zircon’s economic advantages.

Zirconia delivers superior value in demanding applications requiring high strength, wear resistance, or biocompatibility. Medical implants exemplify this value proposition: higher material costs represent small fractions of total device costs while providing critical performance advantages.

Market stability considerations favor zirconia for long-term planning. Zircon markets face supply constraints and demand volatility from cyclical industries. Zirconia benefits from growing technology markets and diversified application base.

Innovation potential differs significantly between materials. Zircon applications remain relatively mature with limited scope for property improvements. Technology advancement favors zirconia: ongoing research in nanostructured ceramics, composite materials, and advanced processing techniques creates new opportunities.

| Value Factor | Zircon Advantage | Zirconia Advantage |

|---|---|---|

| Initial Cost | ✓ Lower purchase price | Higher performance/cost ratio |

| Processing Cost | ✓ Simpler handling | Consistent quality |

| Performance | Adequate for applications | ✓ Superior properties |

| Market Stability | Cyclical demand | ✓ Growing markets |

| Innovation Potential | Limited | ✓ Extensive R&D |

Sustainability considerations increasingly influence material selection. Zircon mining operations face environmental scrutiny and community relations challenges. Rehabilitation costs and regulatory compliance add long-term expenses.

Zirconia processing allows better environmental control and waste minimization. Sustainability trends favor zirconia: recyclability, energy efficiency improvements, and reduced environmental impact align with corporate sustainability goals.

Investment in research and development shows clear differences. Zircon research focuses primarily on beneficiation improvements and new deposit development. Zirconia R&D spans advanced processing, new applications, and property enhancements with significantly higher funding levels.

What Should Procurement Teams Consider?

Supplier evaluation criteria must reflect material-specific requirements. Zircon procurement emphasizes consistent quality, reliable supply, and competitive pricing. Key evaluation factors include radioactivity levels, particle size distribution, and chemical composition stability.

Technical capabilities matter differently for each material. Zircon suppliers should demonstrate mining expertise, beneficiation technology, and quality control systems. Due diligence requirements include: mine reserves, production capacity, and environmental compliance records.

Zirconia supplier evaluation focuses on processing expertise, quality systems, and technical support capabilities. Manufacturing certifications (ISO 9001, AS9100, ISO 13485) become critical for regulated applications. R&D capabilities and new product development support add value for innovative applications.

Quality specifications require careful definition. Zircon specifications typically address chemical composition, particle size, radioactivity, and moisture content. Standard grades suffice for most applications, but premium specifications may justify cost premiums.

Zirconia specifications become more complex, covering phase composition, surface area, purity levels, and particle morphology. Specification precision matters: minor variations can significantly impact final product performance in critical applications.

Contract negotiation strategies should reflect market dynamics. Zircon contracts often include price adjustment mechanisms tied to market indices or raw material costs. Volume commitments may secure better pricing but increase inventory risks.

Zirconia contracts emphasize quality guarantees and technical support provisions. Long-term agreements provide supply security and enable supplier investment in quality improvements. Partnership approaches work better: collaborative relationships often deliver more value than purely transactional arrangements.

| Procurement Factor | Zircon Focus | Zirconia Focus |

|---|---|---|

| Primary Criteria | Price, availability | Quality, technical support |

| Contract Terms | Volume-based pricing | Quality guarantees |

| Supplier Relationship | Transactional | Partnership-oriented |

| Quality Control | Standard testing | Advanced characterization |

| Inventory Strategy | Higher safety stock | Just-in-time delivery |

Inventory management approaches differ based on material characteristics and supply risks. Zircon’s supply concentration and longer lead times justify higher safety stock levels. Typical inventory targets range from 60-90 days of consumption.

Zirconia’s higher value and shorter shelf life favor lean inventory approaches. Working capital optimization becomes critical: 30-45 days inventory often provides adequate supply security while minimizing carrying costs.

Risk mitigation techniques should address material-specific vulnerabilities. Zircon procurement risks include supply disruptions, quality variations, and price volatility. Diversified supplier base and flexible contract terms help manage these risks.

How Will Market Dynamics Change by 2025?

Technology advancement will reshape both markets significantly. Additive manufacturing growth creates new opportunities for both materials, particularly in customized components and rapid prototyping applications. 3D printing of ceramics requires specific powder characteristics that may favor certain grades.

Regulatory changes impact markets differently. Environmental regulations affect zircon mining operations, potentially constraining supply and increasing costs. Compliance costs are rising: new environmental standards and community engagement requirements add operational complexity.

Zirconia markets benefit from medical device regulations that emphasize biocompatibility and quality standards. Stricter requirements may eliminate lower-quality suppliers while creating opportunities for premium producers.

New market entrants could disrupt established dynamics. Chinese zirconia producers continue expanding capacity and improving quality. African zircon projects may increase supply diversity but face infrastructure and political risks.

Demand shifts reflect broader economic trends. Electrification drives change: electric vehicle adoption increases demand for advanced ceramics while reducing traditional automotive applications. Electronics miniaturization favors high-performance materials like zirconia.

| Market Driver | Impact on Zircon | Impact on Zirconia |

|---|---|---|

| Electric Vehicles | Reduced engine casting | Increased electronics demand |

| 5G Technology | Minimal | Strong growth in components |

| Medical Devices | Limited growth | Significant expansion |

| Sustainability | Supply constraints | Processing advantages |

| Automation | Stable demand | Growing sensor applications |

Competition from alternative materials poses different threats. Zircon faces competition from synthetic alternatives and recycled materials in some applications. Cost pressure intensifies: customers evaluate total system costs rather than material costs alone.

Zirconia competes with advanced ceramics like silicon carbide and aluminum oxide in specific applications. Performance advantages and established supply chains provide competitive protection, but continuous innovation remains necessary.

Strategic recommendations for buyers include diversifying supplier bases, investing in supplier relationships, and monitoring technology developments. Proactive planning pays off: early engagement with emerging suppliers and technologies can provide competitive advantages.

Conclusion

The comparison between zircon and zirconia powder markets reveals distinct value propositions for different applications and procurement strategies. Zircon offers cost-effective solutions for high-volume, temperature-resistant applications, while zirconia provides superior performance for demanding technical applications. Procurement teams can achieve 15-25% cost savings by optimizing material selection based on actual performance requirements rather than default specifications. Global Industry’s technical team provides comprehensive material evaluation services to help manufacturers select optimal powder solutions for specific applications. Contact our materials specialists today for a customized analysis of your powder requirements and access our supplier network optimization tools to streamline your procurement process.

FAQ Section

Q1: Can zircon and zirconia powders be used interchangeably in applications?

No, they cannot be used interchangeably. Zircon (ZrSiO4) and zirconia (ZrO2) have different chemical compositions and properties. Zircon is primarily used in foundry applications and ceramics, while zirconia is preferred for high-performance applications requiring superior mechanical properties and chemical resistance.

Q2: Which material typically costs more per ton?

Zirconia powder generally costs more than zircon powder due to its more complex processing requirements and higher purity levels. However, prices vary significantly based on grade, purity, and specific application requirements. High-grade zirconia can cost 2-3 times more than standard zircon powder.

Q3: What are the main quality factors that affect pricing?

Key quality factors include purity levels, particle size distribution, chemical composition consistency, and specific surface area. For zircon, factors like titanium content and radioactivity levels matter. For zirconia, stabilizer content (yttria, magnesia) and phase composition are critical pricing determinants.

Q4: How stable are the supply chains for both materials?

Zircon supply is more geographically concentrated, with Australia and South Africa being major producers, creating some supply risk. Zirconia supply is more diversified globally, but depends on zircon as a raw material. Both markets face challenges from mining regulations and environmental concerns.

Q5: Which market is expected to grow faster through 2025?

The zirconia market is projected to grow faster, driven by expanding electronics, medical device, and automotive applications. Growth rates of 6-8% annually are expected for zirconia, compared to 3-5% for zircon, primarily due to zirconia’s use in advanced technology applications.