Procurement teams face significant budgetary challenges due to zirconium silicate market price volatility. Price fluctuations of this critical industrial mineral can substantially impact production costs and supply chain stability. This article provides systematic methods for monitoring and forecasting zirconium silicate price trends, helping you develop more effective procurement strategies. As industrial mineral market analysts, we’ve compiled data from major global suppliers and market research institutions to provide reliable information for your decision-making process.

Why Are Zirconium Silicate Prices Critical for Procurement Planning?

Zirconium silicate serves as a key raw material in industrial production, with price fluctuations directly affecting cost structures and profit margins. For manufacturers dependent on this material, understanding and predicting price changes proves absolutely essential.

Zirconium silicate occupies a unique strategic position in global markets. As a fundamental ingredient in ceramics, refractories, foundry, and precision casting industries, supply stability directly impacts production continuity. When prices suddenly increase, unprepared companies may face profit compression or forced product price increases, potentially losing market competitiveness.

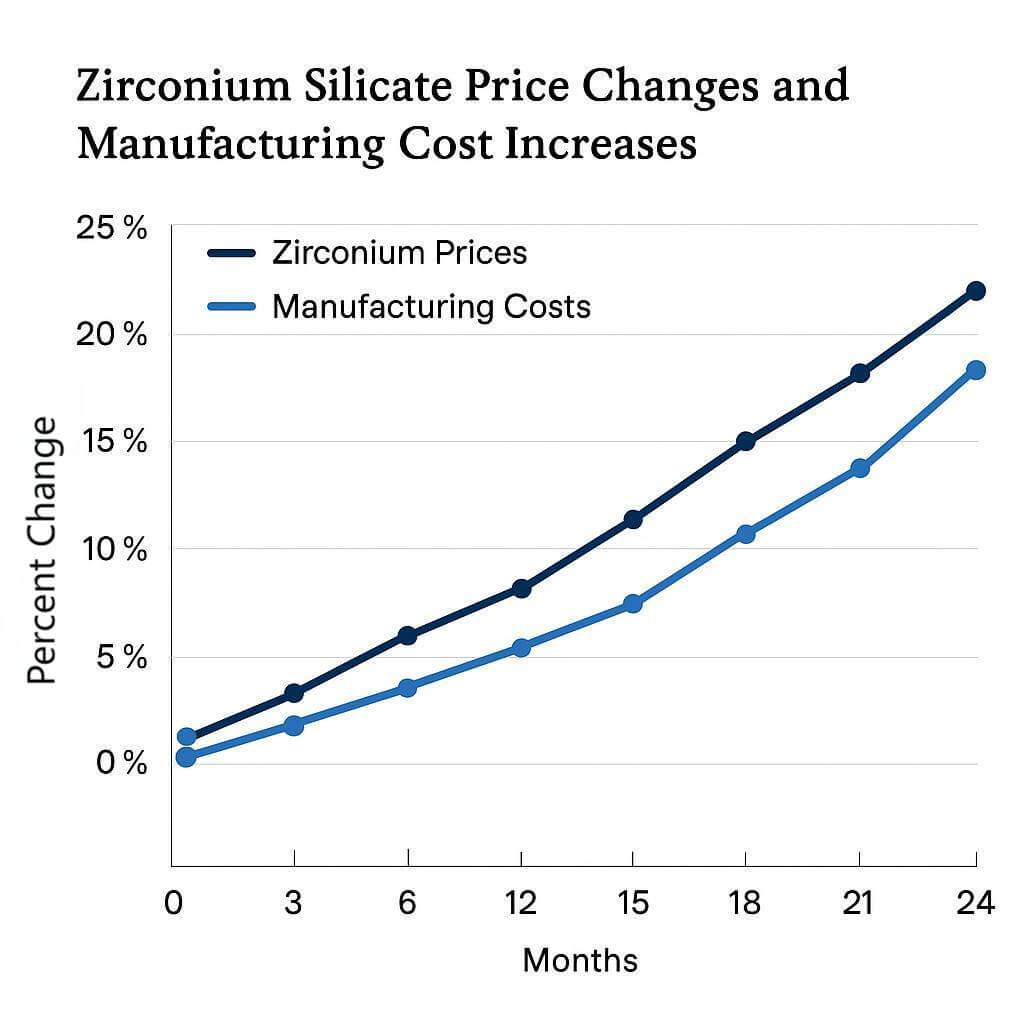

According to the International Mining Association’s 2023 Market Report, zirconium silicate prices have shown 15-20% volatility over the past 24 months, making proactive monitoring essential for cost control.

The truth is, price fluctuations affect not just direct procurement costs but trigger chain reactions throughout supply chains. For example, when major Australian mining areas reduced production due to tightened environmental regulations, global zirconium silicate prices rose nearly 30% in 2021. This sudden change forced many ceramic manufacturers to reassess product pricing strategies.

Procurement teams have compelling business reasons to monitor zirconium silicate price trends. Through systematic price change tracking, companies can:

| Business Value of Price Monitoring | Specific Impact |

|---|---|

| Improved Budget Accuracy | 20-30% reduction in budget variance |

| Enhanced Negotiation Leverage | 5-15% average procurement cost reduction |

| Optimized Inventory Strategy | 10-25% reduction in inventory holding costs |

| Improved Risk Management | 40% reduction in supply disruption risk |

For a mid-sized ceramic manufacturer consuming 100 tons of zirconium silicate annually, optimizing purchase timing alone can save $50,000-$80,000 in raw material costs yearly. This clearly demonstrates why price monitoring should become a core procurement team function.

What Global Factors Drive Zirconium Silicate Market Prices?

Zirconium silicate market prices respond to multiple global factors; understanding these drivers helps predict future price trends.

Australia, South Africa, and China, as major global zirconium silicate producers, exert decisive influence on market prices through their supply dynamics. Australia currently accounts for approximately 40% of global production, with any factors affecting its output causing significant global market fluctuations. Data from 2023 shows that when Iluka Resources announced planned maintenance at its Western Australian mining site, global prices increased 15% within two weeks.

Mining and processing cost changes also significantly drive price volatility. Rising fuel prices, increased labor costs, and heightened environmental compliance requirements all push production costs upward. Worth noting, environmental compliance costs have risen from 8% to nearly 20% of total zirconium silicate production costs over the past five years.

| Major Producing Countries | Global Production Share | Recent Supply Trends | Price Impact Level |

|---|---|---|---|

| Australia | 40% | Stable, slight decline | High |

| South Africa | 25% | Fluctuating, affected by energy crisis | Medium-High |

| China | 15% | Growing, but increasing environmental restrictions | Medium |

| Other Countries | 20% | Diversifying, new mining areas under development | Low to Medium |

International trade policies and tariff changes can dramatically alter market landscapes. In 2022, when China imposed an additional 2% import tariff on Australian mineral products, zirconium silicate prices in Asian markets rose approximately 7%, while European markets remained relatively stable. These regional differences create arbitrage opportunities for companies with global procurement capabilities.

Energy cost fluctuations create ripple effects on zirconium silicate prices, particularly in energy-intensive processing stages. South African zirconium silicate producers remain especially vulnerable to the country’s ongoing electricity crisis, resulting in unstable production and intensified price volatility.

In reality, understanding these global factors’ interactions allows procurement teams to build more accurate forecasting models. For example, by monitoring quarterly production reports from major Australian mining companies, South Africa’s energy situation, and changes in Chinese environmental policies, procurement managers can anticipate potential price movements 3-6 months in advance.

How Do Industry Applications Affect Demand and Pricing?

Demand changes across different industries directly influence zirconium silicate market prices; understanding these industry trends proves crucial for price trend forecasting.

The ceramics and refractories industries, consuming approximately 50% of total demand, most significantly impact market prices. Recent growth in high-end ceramic product demand, particularly in Asian markets, has driven zirconium silicate price increases. The key point lies in recognizing seasonal demand patterns in the ceramics industry, which typically cause price increases during second and third quarters, providing procurement teams opportunities to optimize purchase timing.

| Industry | Zirconium Silicate Consumption Share | Demand Trends | Price Sensitivity |

|---|---|---|---|

| Ceramics and Refractories | 50% | Steady growth, strong Asian markets | High |

| Foundry and Casting Sand | 30% | Cyclical, follows manufacturing sector performance | Medium-High |

| Chemicals and Catalysts | 10% | Steady growth | Medium |

| Emerging Technology Applications | 10% | Rapid growth | Low (but increasing) |

Market demand changes in foundry and casting sand applications also significantly affect prices. This sector connects closely with global manufacturing and automotive industries, making economic cycles clearly influence demand. During the 2020 pandemic, global manufacturing slowdown caused approximately 25% demand reduction in this sector, with prices subsequently falling 15-20%.

Emerging technology applications for zirconium silicate continue growing, particularly in nuclear energy, medical devices, and advanced ceramic materials. Though currently representing a smaller percentage, these applications grow at 8-10% annually, projected over the next five years. These high-value-added applications show lower sensitivity to price fluctuations but increase overall demand pressure.

Competitive pressure from alternative materials warrants analysis. In certain applications, alumina and other synthetic materials can partially substitute zirconium silicate. When zirconium silicate prices exceed certain thresholds (typically $1,400 per ton), some manufacturers consider alternatives, creating ceiling pressure on zirconium silicate prices.

Evidence shows understanding these industry dynamics helps procurement teams predict demand peaks and valleys. For example, by tracking global ceramic production indices and major automotive manufacturers’ quarterly production plans, procurement managers can forecast demand changes 3-4 months ahead, optimizing procurement decisions.

Which Price Indicators Should Procurement Teams Track Monthly?

Procurement teams need regular tracking of several key price indicators for comprehensive understanding of zirconium silicate market dynamics.

Key price indices and market reports provide foundational reliable price information. Price indices from specialized institutions like Industrial Minerals Price Book, Asian Metal, and Argus Media serve as widely recognized industry standards. The trick here involves not relying on single sources but cross-comparing multiple indices for more accurate market pictures. Many procurement teams discover subscribing to at least two different price reporting services significantly improves price intelligence accuracy.

| Price Indicator Type | Recommended Tracking Frequency | Primary Information Sources | Value Assessment |

|---|---|---|---|

| Global Benchmark Price Indices | Weekly/Monthly | Industrial Minerals, Asian Metal | High (Market Benchmark) |

| Regional Spot Prices | Weekly | Regional Trading Platforms, Argus Media | High (Short-term Procurement) |

| Long-term Contract Price Trends | Quarterly | Supplier Reports, Industry Associations | High (Long-term Planning) |

| Freight Indices | Monthly | Baltic Dry Index, Freightos | Medium (Total Cost Analysis) |

Differences between contract prices and spot market prices represent another important monitoring indicator. Typically, long-term contract prices run 10-15% below spot prices, but during market volatility periods, this difference can rapidly change. In Q3 2022, during supply tightness, spot prices in certain regions temporarily exceeded contract prices by over 30%, creating arbitrage opportunities for companies with flexible procurement strategies.

Seasonal price patterns and historical trend analysis help predict cyclical changes. Analyzing data from the past 5 years reveals zirconium silicate prices typically reach their lowest points during first quarters while peaking during third quarters, closely correlating with downstream industry production cycles. Understanding these patterns helps procurement teams optimize purchase timing.

Regional price differences significantly impact global procurement strategies. Asian (particularly Chinese) market prices typically run 5-8% lower than European markets, but transportation costs and delivery times may offset this price advantage. Interestingly, North American market price fluctuations typically lag 1-2 months behind other regions, providing forecast windows for companies with global procurement capabilities.

Procurement teams should establish comprehensive price monitoring dashboards integrating all indicators above. Such systems should:

- Automatically aggregate price data from multiple sources

- Generate trend charts and warning signals

- Integrate with enterprise resource planning (ERP) systems

- Provide forecast analytics based on historical data

What Supply Chain Risks Impact Zirconium Silicate Availability?

Beyond price fluctuations, zirconium silicate supply chains face multiple risks affecting product availability and indirectly driving price changes.

Major supplier concentration and market monopoly risks represent primary considerations. The top five global zirconium silicate producers control approximately 70% of market supply, making markets vulnerable to decisions by few companies. Worryingly, when the second-largest producer declared force majeure due to equipment failure in 2023, global prices increased nearly 20% within one month.

| Supply Chain Risk Type | Risk Level | Potential Price Impact | Mitigation Strategies |

|---|---|---|---|

| Supplier Concentration | High | +15-25% | Multi-source procurement strategies |

| Geopolitical Factors | Medium-High | +10-30% | Regional diversification |

| Transportation and Logistics Challenges | Medium | +5-15% | Flexible delivery options |

| Environmental Regulatory Changes | High | +10-20% | Long-term contract locking |

Geopolitical factors affecting supply chain stability cannot be overlooked. Trade tensions between Australia and China, political instability in South Africa, and Ukraine conflict impacts on global shipping have all previously caused zirconium silicate supply disruptions. Procurement teams should closely monitor political developments in major producing countries and incorporate geopolitical risk into supply strategies.

Transportation and logistics challenges also affect prices and delivery times. Zirconium silicate typically ships via sea freight, making global shipping congestion, rising fuel prices, and container shortages increase total costs. The 2021 Suez Canal blockage caused 4-6 week delivery delays for zirconium silicate to European markets, temporarily increasing spot prices by 12%.

Environmental regulations increasingly restrict mining and processing. Zirconium silicate mining typically involves radioactive elements (thorium and uranium), raising growing regulatory concerns. China and Australia have both tightened environmental standards in recent years, leading to rising compliance costs and some marginal mine closures. This trend will likely continue, potentially causing long-term supply tightening.

From a practical perspective, procurement teams should establish comprehensive supply risk monitoring systems including:

- Regular assessments of key suppliers’ financial health and production capacity

- Multi-regional supply networks reducing dependence on single sources

- Emergency transportation plans with logistics partners

- Close monitoring of environmental regulatory changes in major producing countries

Through proactive management of these supply chain risks, procurement teams can improve supply security and mitigate price fluctuation impacts.

How Can Procurement Teams Develop Effective Price Forecasting Models?

Establishing accurate price forecasting models provides procurement teams with key decision optimization tools, significantly improving procurement efficiency and cost control.

Building internal price tracking systems represents the first step. These systems should collect, organize, and analyze price data from multiple sources. Best practice involves creating centralized databases recording historical prices, supplier quotes, transaction prices, and market indices, using statistical tools to identify trends and outliers.

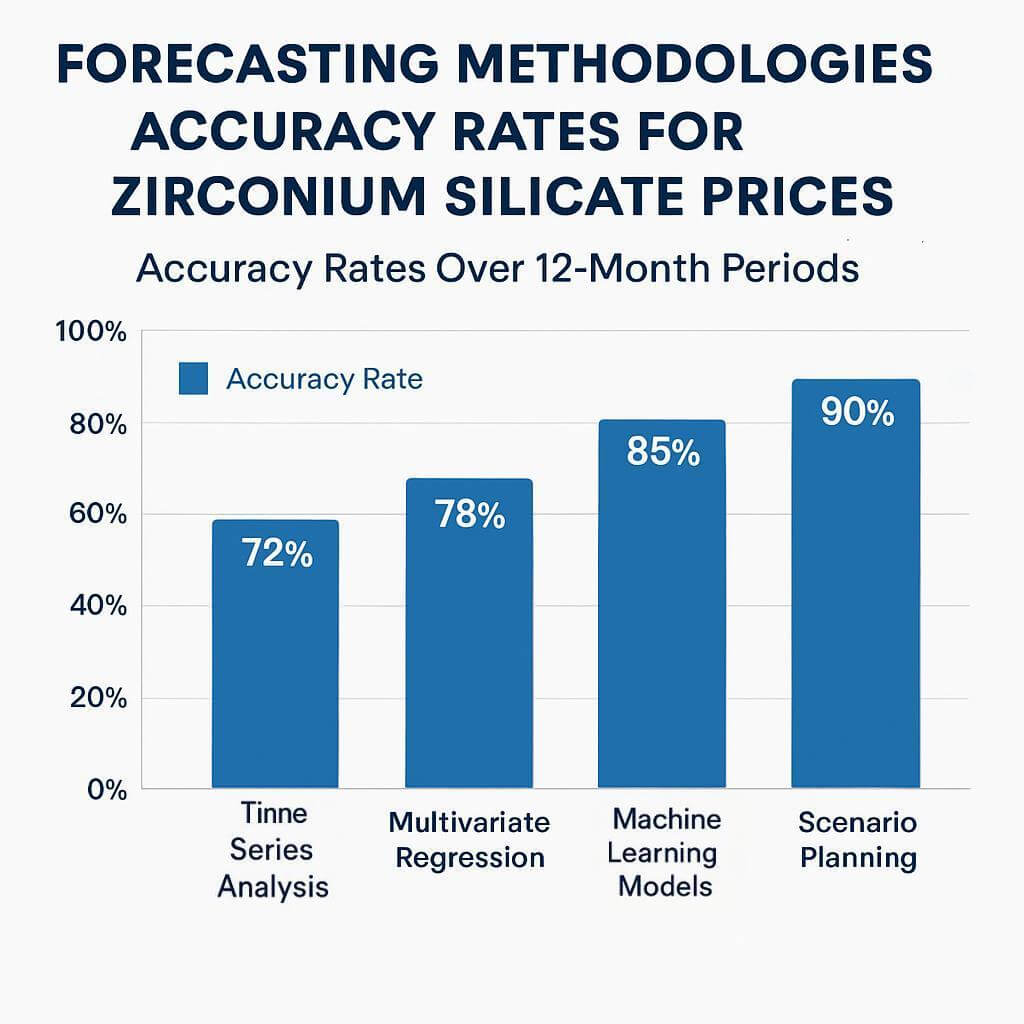

| Forecasting Model Type | Applicable Time Range | Accuracy | Required Data Inputs |

|---|---|---|---|

| Time Series Analysis | Short-term (1-3 months) | High | Historical price data, minimum 2 years |

| Multivariate Regression | Medium-term (3-6 months) | Medium-High | Price data + macroeconomic indicators |

| Machine Learning Models | Long-term (6-12 months) | Medium | Large historical datasets + multiple variables |

| Scenario Planning | Long-term (1-3 years) | Low to Medium | Market intelligence + expert judgment |

Integrating multiple data sources for predictive analytics proves crucial. Beyond price data, effective forecasting models should consider:

- Economic indicators from major producing countries

- Energy price trends

- Production indices from downstream industries

- Global shipping and logistics indicators

- Capacity utilization rates from major producers

Establishing price intelligence sharing mechanisms with suppliers provides unique market insights. Many leading procurement teams have established “open book” relationships with key suppliers, regularly exchanging market intelligence and cost structure information. This transparency helps both parties better plan for and mitigate price fluctuation impacts.

Utilizing artificial intelligence and predictive tools to improve accuracy represents the latest trend. Machine learning algorithms can process large data volumes and identify subtle patterns human analysts might miss. One leading ceramic manufacturer reported increasing zirconium silicate price forecast accuracy from 65% to over 85% after implementing AI-driven prediction systems.

From a utilitarian standpoint, small and medium enterprises can start with these simple steps:

- Create spreadsheets recording weekly price data and key market events

- Use moving averages and seasonal adjustments to analyze historical trends

- Establish regular market intelligence exchange mechanisms with key suppliers

- Gradually introduce more sophisticated statistical tools and forecasting techniques

Regardless of approach, regular evaluation and adjustment of forecasting models remains critical. The most effective systems track forecast accuracy and continuously optimize algorithms and parameters based on actual results.

What Hedging and Contracting Strategies Minimize Price Volatility?

Appropriate hedging and contracting strategies effectively mitigate zirconium silicate price fluctuation impacts on businesses, ensuring supply stability and cost predictability.

Balancing long-term contracts with short-term procurement provides the foundation. Most successful procurement teams adopt “70/30” or “80/20” hybrid strategies, locking 70-80% of requirements through long-term contracts while maintaining flexibility with remaining portions to leverage spot market opportunities. The advantage of this approach lies in providing both price stability and adaptability to market changes.

| Contract Strategy | Advantages | Disadvantages | Best Application Scenarios |

|---|---|---|---|

| Fixed-Price Long-Term Contracts | High price stability, budget certainty | Lost downside opportunities, supplier premiums | Expected price increases, strict budgets |

| Index-Linked Contracts | High transparency, follows market trends | Volatility remains, requires index monitoring | Moderate price volatility, transparency needed |

| Tiered Pricing Agreements | Volume discounts, moderate flexibility | Complex management, requires accurate demand forecasting | Predictable demand, larger scale |

| Spot Purchasing | Maximum flexibility, market opportunity capture | High volatility, supply risks | Supplementary strategy, market downturns |

Price locking and tiered pricing agreement negotiation techniques warrant mastering. Successful procurement managers typically:

- Negotiate long-term contracts during market troughs

- Link contracts to reliable market indices rather than fixed prices

- Include “cap and floor” clauses limiting price fluctuation ranges

- Design quantity flexibility clauses allowing order adjustments within specific ranges

Inventory management strategies prove critical for addressing price volatility. Strategic inventory management represents not just logistics issues but financial strategy. Increasing inventory when prices reach historical lows while reducing purchases during price increases can significantly lower average procurement costs. One leading refractory materials manufacturer saved approximately 12% in raw material costs during 2022’s price volatility period through this “counter-cyclical” inventory strategy.

Multi-supplier procurement strategies show significant risk diversification effects. Relying on single suppliers increases price volatility and supply disruption risks. Establishing networks of 3-5 qualified suppliers from different regions improves supply resilience and creates price competition. Worth mentioning, geographical diversification proves particularly important since regional events (natural disasters or political turmoil) may simultaneously affect multiple suppliers in the same region.

Innovative risk-sharing models have gained popularity. Some advanced procurement teams implement:

- Cost-saving sharing agreements with suppliers

- Consumption volume commitments in exchange for price protection

- Joint purchasing arrangements with peer companies

- Back-to-back pricing mechanisms with key customers, transferring some price risk downstream

Through comprehensive application of these strategies, procurement teams can minimize zirconium silicate price fluctuation impacts on company financial performance while ensuring supply continuity and quality stability.

Conclusion

Zirconium silicate price monitoring proves critical for procurement teams, directly impacting corporate cost control and supply chain stability. Through systematic tracking of global supply factors, industry demand changes, and key price indicators, procurement professionals can forecast market trends and optimize decisions. Data shows companies implementing comprehensive price monitoring strategies average 8-12% reductions in raw material costs. We recommend partnering with Global Industry’s expert team for customized zirconium silicate market analysis and procurement strategy consulting, helping maintain competitive advantages in volatile markets. Visit our Mineral Market Intelligence Center for additional professional resources and tools to enhance your procurement performance.

FAQ Section

Q1: What is the typical range of zirconium silicate market price fluctuations? Zirconium silicate price fluctuations typically range 10-25% annually, potentially reaching 40-50% during supply disruptions or demand surges. Data from the past five years shows prices varying between $850-$1,600 per ton, requiring procurement teams to prepare for this volatility and incorporate buffers into budget planning.

Q2: How can small procurement teams access reliable zirconium silicate price data? Small teams can access data through industrial minerals price report subscriptions (like Industrial Minerals Price Book), industry association memberships, direct communication channels with major suppliers, and specialized market intelligence platforms. Many suppliers also offer monthly market briefings, providing cost-effective information sources.

Q3: How does zirconium silicate price stability compare to other industrial minerals? Zirconium silicate shows medium price volatility compared to other industrial minerals like titanium sands and kaolin. It fluctuates less dramatically than rare earth elements but remains less stable than commodities like limestone or silica sand. This medium volatility primarily stems from specialized applications and limited supply sources.

Q4: How often should procurement teams review zirconium silicate purchasing strategies? Purchasing strategies warrant quarterly reviews at minimum, with monthly reviews during market turbulence periods. Annual in-depth assessments prove crucial for long-term contract negotiations, while more frequent checks help identify short-term opportunities or risks. Strategy reviews should align with company production planning and financial cycles.

Q5: How do environmental regulations affect future zirconium silicate price trends? Environmental regulations drive zirconium silicate prices upward through increased compliance costs, restricted mining activities in certain regions, and promotion of more sustainable processing technologies. Particularly strengthened mining waste management and radiation safety standards will likely increase production costs 5-15% over the next 3-5 years. Procurement teams should monitor environmental policy changes in major producing countries.