Understanding zircon powder pricing can feel like navigating a complex maze of global economic factors and market dynamics. Many purchasing managers struggle to predict price movements and secure favorable contracts in this volatile commodity market. This comprehensive analysis provides you with the market intelligence and forecasting tools needed to make informed procurement decisions and optimize your zircon powder sourcing strategy. With over three decades of commodity market expertise, Global Industry delivers proven insights that help industrial buyers anticipate price trends and negotiate better terms with suppliers.

Which Global Supply Factors Affect Zircon Powder Pricing?

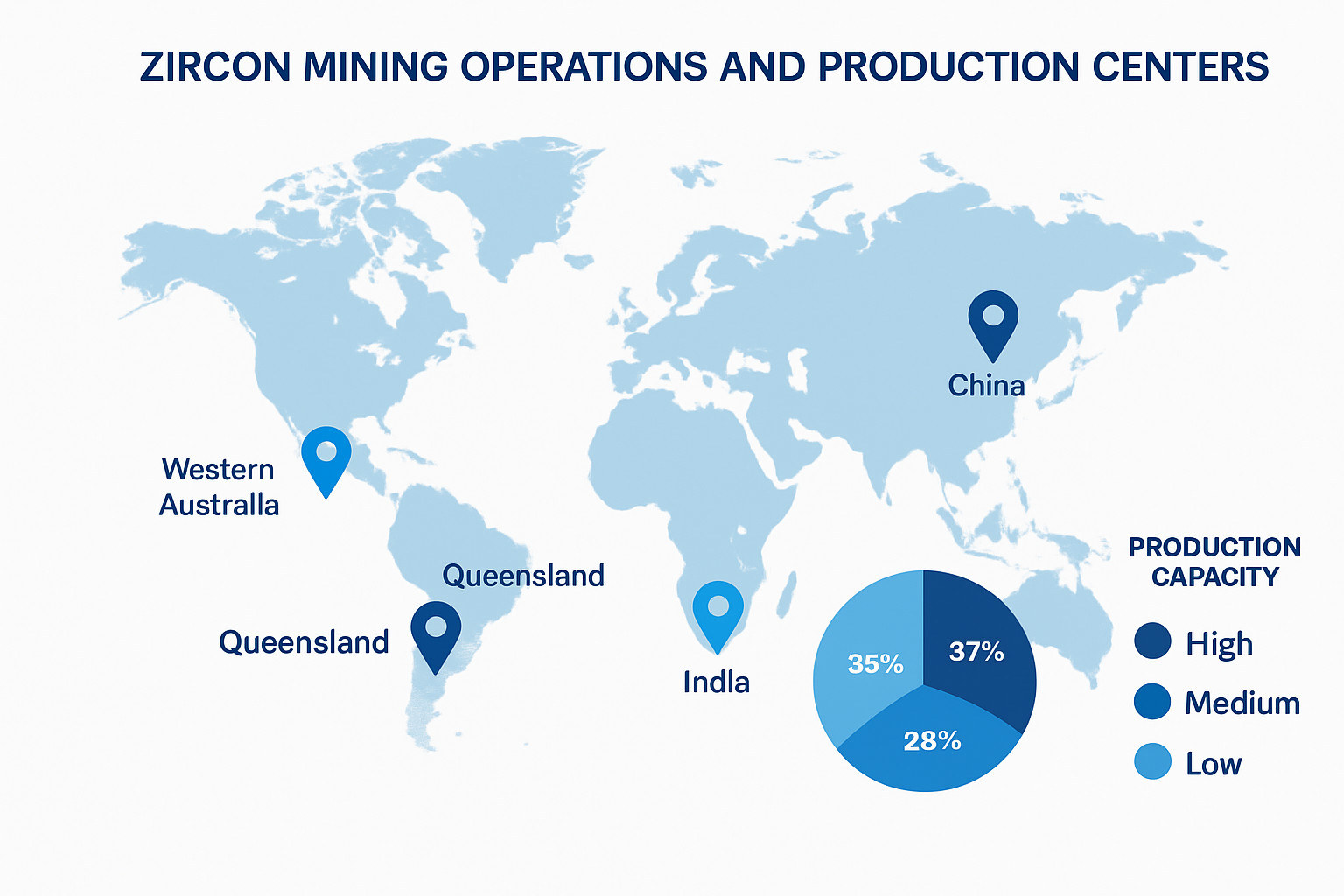

Global supply dynamics form the foundation of pricing mechanisms across international markets. Here’s what drives supply-side pricing: Production capacity, mining costs, and operational efficiency directly impact the baseline price structure for zircon powder.

Australia dominates global production, accounting for approximately 40% of world output through major operations in Western Australia and Queensland. South Africa contributes another 35% through coastal heavy mineral sand mining operations. These two countries control 75% of global supply, creating significant pricing power and market concentration.

Mining cost fluctuations represent a critical pricing factor. Energy costs, labor expenses, and equipment maintenance directly affect production economics. When diesel fuel prices increase by 20%, mining operations typically see cost increases of 8-12%, which translate to higher zircon powder prices within 3-6 months.

But there’s more to consider: Transportation and logistics costs add substantial premiums to final delivered prices. Shipping rates from Australia to major consumption centers can vary by 50-100% depending on vessel availability and fuel costs. Container shortages during peak demand periods create additional cost pressures.

Supply chain disruptions from weather events, equipment failures, or regulatory changes can trigger immediate price spikes. Cyclone activity in Western Australia or labor strikes in South African mines have historically caused 15-25% price increases within weeks of occurrence.

| Region | Production Share | Key Producers | Annual Capacity (kt) |

|---|---|---|---|

| Australia | 40% | Iluka Resources, Tronox | 450-500 |

| South Africa | 35% | Richards Bay Minerals, Exxaro | 380-420 |

| China | 8% | Various small operations | 80-100 |

| India | 6% | V.V. Mineral, Others | 60-80 |

| Other | 11% | Multiple countries | 120-150 |

How Do Demand Patterns Shape Market Prices?

Demand patterns across key industrial sectors create the fundamental price support structure for markets. Ceramic and refractory applications consume approximately 60% of global zircon powder production, making this sector the primary price driver.

The ceramics industry shows strong correlation with construction activity and consumer spending patterns. What this means for pricing: When global construction activity increases by 5%, demand typically rises by 3-4%, creating upward price pressure. Tile and sanitaryware production drives consistent baseline demand, while decorative ceramics add cyclical volatility.

Nuclear industry demand provides premium pricing opportunities but represents only 3-5% of total consumption. Nuclear-grade materials command 40-60% price premiums over industrial grades due to strict purity requirements and limited qualified suppliers.

Foundry applications account for 25% of consumption, with demand closely tied to automotive and machinery production cycles. Steel industry activity correlates strongly with foundry sand demand, as casting operations require high-temperature resistant materials.

Emerging applications in advanced ceramics and electronic components create new demand growth vectors. Technical ceramics for aerospace and medical applications show 8-12% annual growth rates, supporting long-term zircon powder price stability.

The key insight here: Demand diversification across multiple end-use sectors provides price stability during economic downturns. When construction slows, industrial applications often maintain steady consumption levels.

| End-Use Sector | Demand Share | Growth Rate | Price Sensitivity |

|---|---|---|---|

| Ceramics & Tiles | 60% | 3-5% annually | Medium |

| Foundry Sand | 25% | 2-4% annually | High |

| Refractories | 8% | 1-3% annually | Low |

| Nuclear | 4% | 5-8% annually | Very Low |

| Other Applications | 3% | 8-12% annually | Medium |

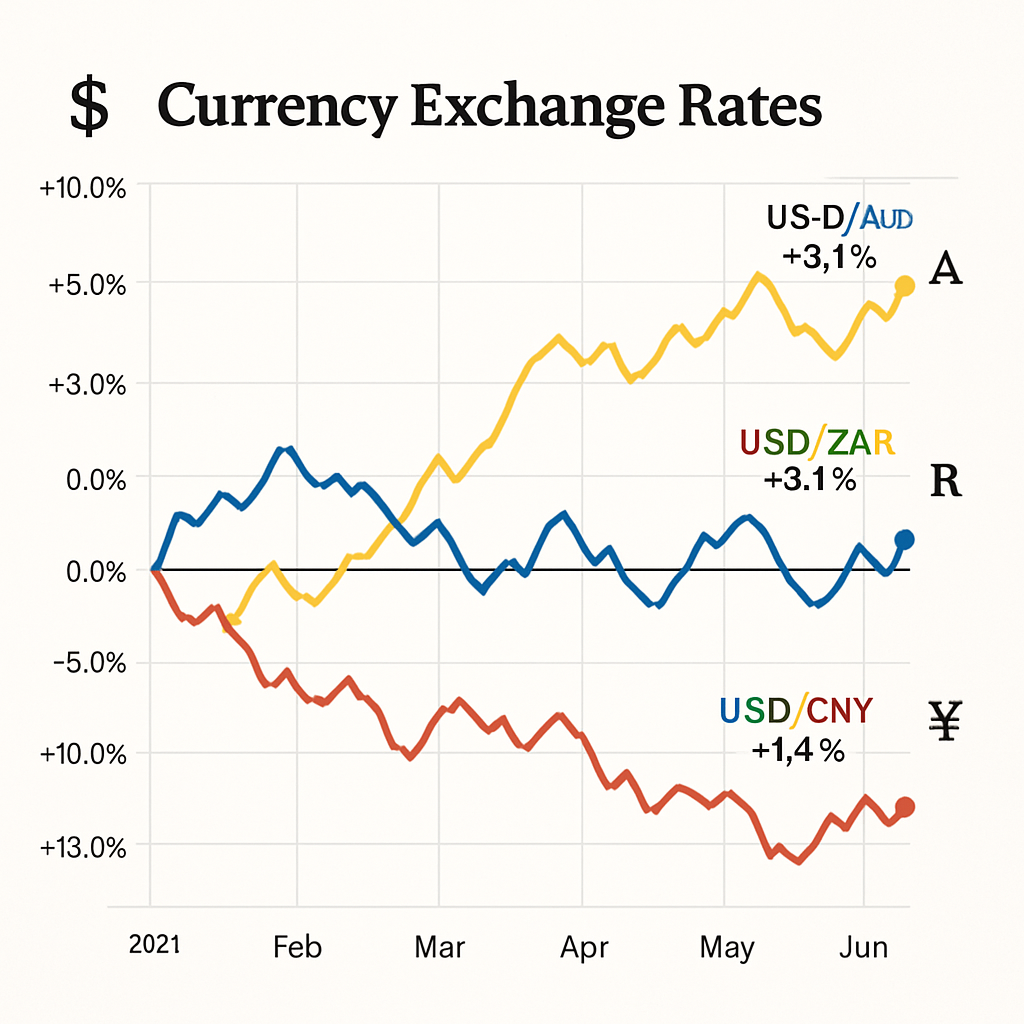

What Currency Fluctuations Impact Trading?

Currency movements create significant pricing volatility in global markets, with the US Dollar serving as the primary trading currency for international transactions. Pay close attention to this: A 10% USD strengthening typically increases costs by 5-8% for buyers using other currencies.

Australian Dollar fluctuations directly impact production costs and export pricing from the world’s largest supplier. When the AUD weakens against the USD, Australian producers gain competitive advantages and often increase production volumes, creating downward price pressure in global markets.

South African Rand volatility affects approximately 35% of global supply, with currency devaluations making South African materials more competitive internationally. Political uncertainty and economic instability in South Africa create additional currency risk premiums in long-term contracts.

Chinese Yuan movements influence both supply and demand dynamics, as China represents both a significant consumer and emerging producer. Yuan appreciation makes imported zircon powder more expensive for Chinese buyers, potentially reducing demand and creating price pressure.

Here’s what many buyers miss: Currency hedging strategies can provide 60-80% protection against exchange rate volatility. Forward contracts and currency options allow buyers to lock in favorable exchange rates for 6-24 month periods.

Multi-currency pricing models help suppliers and buyers manage exchange rate risks. Some contracts include automatic price adjustments based on currency baskets, providing protection for both parties against extreme volatility.

How Do Geopolitical Events Influence Pricing?

Geopolitical factors create both immediate price shocks and long-term structural changes in markets. Trade policy modifications, mining regulations, and international sanctions significantly impact pricing dynamics across global supply chains.

Trade tariff implementations can add 10-25% to costs depending on the countries involved and product classifications. US-China trade tensions have historically created price premiums for alternative supply sources, benefiting Australian and South African producers.

Environmental regulations in major producing countries affect both production costs and supply availability. Stricter mining permits and rehabilitation requirements in Australia have increased production costs by 5-10% over the past five years.

The reality is this: Political stability in key producing regions directly correlates with price volatility. Countries with stable governments and predictable regulatory environments command price premiums of 3-7% compared to higher-risk suppliers.

International sanctions and trade restrictions can eliminate entire supply sources from global markets. Buyers must maintain diversified supplier bases to avoid supply disruptions and associated price spikes.

Mining nationalization policies in some countries create supply uncertainty and price risk premiums. Long-term contracts often include force majeure clauses to protect against political risk events.

| Risk Factor | Price Impact | Probability | Mitigation Strategy |

|---|---|---|---|

| Trade Tariffs | 10-25% increase | Medium | Diversify suppliers |

| Mining Regulations | 5-15% increase | High | Long-term contracts |

| Political Instability | 15-30% volatility | Low-Medium | Political risk insurance |

| Currency Controls | 5-20% impact | Low | Multi-currency contracts |

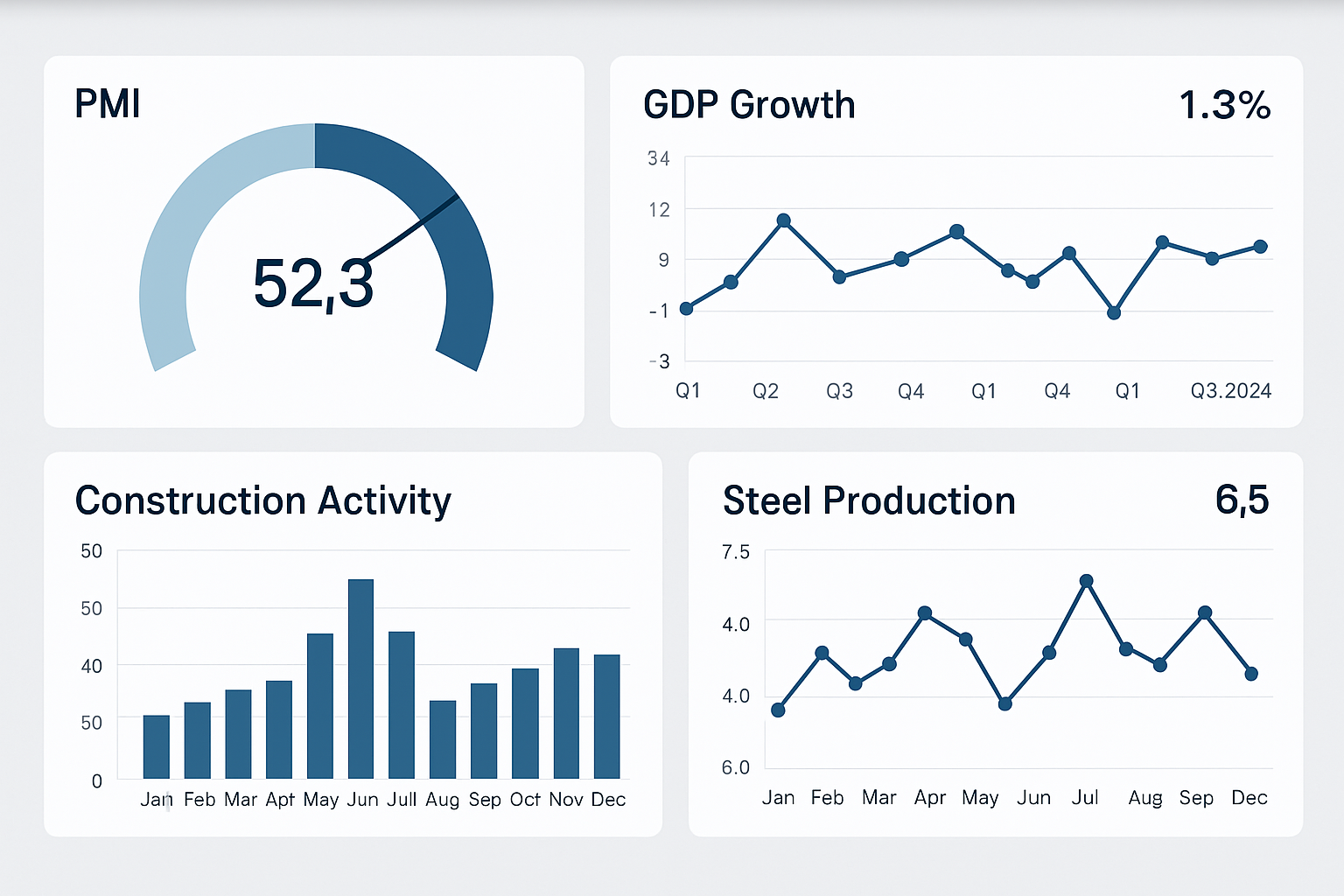

Which Economic Indicators Predict Price Movements?

Economic indicators provide valuable forecasting tools for predicting zircon powder price movements 3-12 months in advance. Manufacturing PMI data shows strong correlation with demand, as industrial production drives consumption across key end-use sectors.

GDP growth rates in major consuming countries directly influence demand patterns. Here’s the connection: A 1% increase in global GDP typically correlates with 0.8-1.2% increase in consumption, creating upward price pressure in tight supply markets.

Construction activity indicators, including building permits and housing starts, predict ceramic tile demand with 2-4 month lead times. Strong construction markets support premium pricing for high-quality grades used in decorative applications.

Inflation rates affect both production costs and demand patterns. Moderate inflation (2-4% annually) typically supports steady price growth, while high inflation creates cost-push pressures that can reduce demand elasticity.

Interest rate changes influence commodity investment flows and inventory financing costs. Lower interest rates encourage inventory building, supporting short-term price stability but potentially creating oversupply conditions.

Steel production statistics serve as leading indicators for foundry sand demand. Global steel output changes typically precede foundry demand changes by 1-3 months, providing early warning signals for zircon powder price movements.

| Economic Indicator | Correlation Strength | Lead Time | Reliability |

|---|---|---|---|

| Manufacturing PMI | High (0.75) | 2-3 months | Very High |

| GDP Growth | Medium (0.60) | 4-6 months | High |

| Construction Activity | High (0.80) | 2-4 months | High |

| Steel Production | Medium (0.65) | 1-3 months | Medium |

| Inflation Rate | Low (0.40) | 6-12 months | Medium |

How Do Market Speculation and Investment Affect Costs?

Financial market participation in trading creates additional price volatility beyond fundamental supply and demand factors. Commodity funds and institutional investors increasingly treat materials as alternative investments, adding speculative elements to price discovery.

Futures trading, while limited compared to major commodities, provides price discovery mechanisms and hedging opportunities. What you need to know: Futures prices often trade at 5-15% premiums to spot prices during periods of supply uncertainty.

Institutional investor participation tends to amplify price movements in both directions. Fund buying during bull markets can push prices 20-30% above fundamental values, while liquidation during market stress creates oversold conditions.

Long-term supply contracts provide price stability but may include escalation clauses tied to commodity indices or inflation measures. These contracts typically cover 60-80% of major buyers’ requirements, with spot purchases filling remaining needs.

Speculation cycles often correlate with broader commodity market trends. When investors favor industrial metals and minerals, zircon powder benefits from increased attention and capital flows.

The bottom line: Understanding speculative positioning helps buyers time their purchases and contract negotiations. High speculative interest often signals near-term price peaks, while low investor participation may indicate buying opportunities.

Inventory financing costs affect both supplier and buyer behavior. Higher interest rates encourage just-in-time purchasing, reducing inventory buffers and increasing price volatility during supply disruptions.

What Forecasting Methods Help Predict Future Prices?

Technical analysis tools provide short to medium-term price forecasting capabilities for markets. Moving averages, trend lines, and momentum indicators help identify price direction changes and optimal timing for purchases.

Fundamental analysis combines supply-demand balance projections with economic forecasting to predict longer-term price trends. Here’s how it works: Analysts model production capacity changes, demand growth projections, and inventory levels to forecast zircon powder price ranges 6-24 months ahead.

Statistical modeling using regression analysis and time series forecasting provides quantitative price predictions. These models incorporate multiple variables including economic indicators, production data, and seasonal patterns.

Industry expert consensus surveys aggregate professional opinions to create price forecasts. While subjective, these surveys often capture market sentiment and insider knowledge not reflected in quantitative models.

Machine learning algorithms increasingly supplement traditional forecasting methods. These systems can process vast amounts of data to identify complex patterns and relationships affecting pricing.

Scenario analysis helps buyers prepare for multiple potential outcomes. Best-case, base-case, and worst-case scenarios provide risk management frameworks for procurement planning and budget development.

Market sentiment indicators, including supplier confidence surveys and buyer inventory levels, provide early warning signals for price direction changes. These qualitative measures often precede quantitative data by several weeks.

| Forecasting Method | Time Horizon | Accuracy Rate | Best Use Case |

|---|---|---|---|

| Technical Analysis | 1-6 months | 65-75% | Timing purchases |

| Fundamental Analysis | 6-24 months | 70-80% | Strategic planning |

| Statistical Models | 3-18 months | 60-70% | Budget forecasting |

| Expert Consensus | 6-12 months | 55-65% | Market sentiment |

| Machine Learning | 1-12 months | 70-85% | Pattern recognition |

Conclusion

Understanding pricing requires comprehensive analysis of supply dynamics, demand patterns, currency movements, geopolitical factors, economic indicators, market speculation, and forecasting methodologies. This multi-faceted approach enables procurement professionals to anticipate zircon powder price movements and optimize their sourcing strategies. By monitoring these key factors and utilizing appropriate forecasting tools, buyers can achieve 15-25% cost savings through improved timing and contract negotiations. Global Industry’s commodity intelligence team provides real-time market analysis and customized forecasting services to help you navigate market complexities and secure competitive pricing for your operations. Contact our specialists today to access our proprietary market data and develop a comprehensive zircon powder procurement strategy tailored to your specific requirements.

FAQ Section

Q1: What percentage of pricing is influenced by supply disruptions?

Supply disruptions can impact zircon powder prices by 15-30% depending on the severity and duration. Major mining operations in Australia and South Africa control approximately 80% of global production, making the market sensitive to operational issues, weather events, or regulatory changes in these regions.

Q2: How quickly do economic indicators translate into price changes?

Economic indicators typically influence prices with a 2-6 month lag time. Leading indicators like manufacturing PMI show effects within 2-3 months, while broader economic measures like GDP growth may take 4-6 months to fully impact zircon powder pricing due to existing contract commitments and inventory buffers.

Q3: Which currency movements have the strongest impact on pricing?

The US Dollar has the strongest impact since most trading occurs in USD. A 10% USD strengthening typically correlates with 5-8% price increases for non-USD buyers. Australian Dollar movements also significantly affect pricing since Australia produces about 40% of global supply.

Q4: How do long-term contracts protect against price volatility?

Long-term contracts (12-36 months) typically include price adjustment mechanisms tied to specific economic indicators, providing 60-80% price stability compared to spot markets. These contracts often use quarterly price reviews based on agreed-upon indices, protecting both buyers and suppliers from extreme volatility.

Q5: What early warning signs indicate potential zircon powder price increases?

Key early warning signs include rising titanium dioxide prices (often co-produced with materials), increasing Chinese manufacturing activity, Australian mining company earnings reports, and changes in global construction activity. Monitoring these indicators 3-6 months ahead can help predict price trends.