The global zircon powder market growth is experiencing remarkable acceleration, with projections indicating a trajectory toward $1.8 billion by 2033. This specialized material, derived from zirconium silicate minerals, has become increasingly vital across multiple industries due to its exceptional properties. Understanding the key drivers behind this zircon powder market growth provides valuable insights for investors, manufacturers, and industry stakeholders seeking to capitalize on emerging opportunities in this dynamic sector through 2033.

What Is the Current State of the Global Zircon Powder Market?

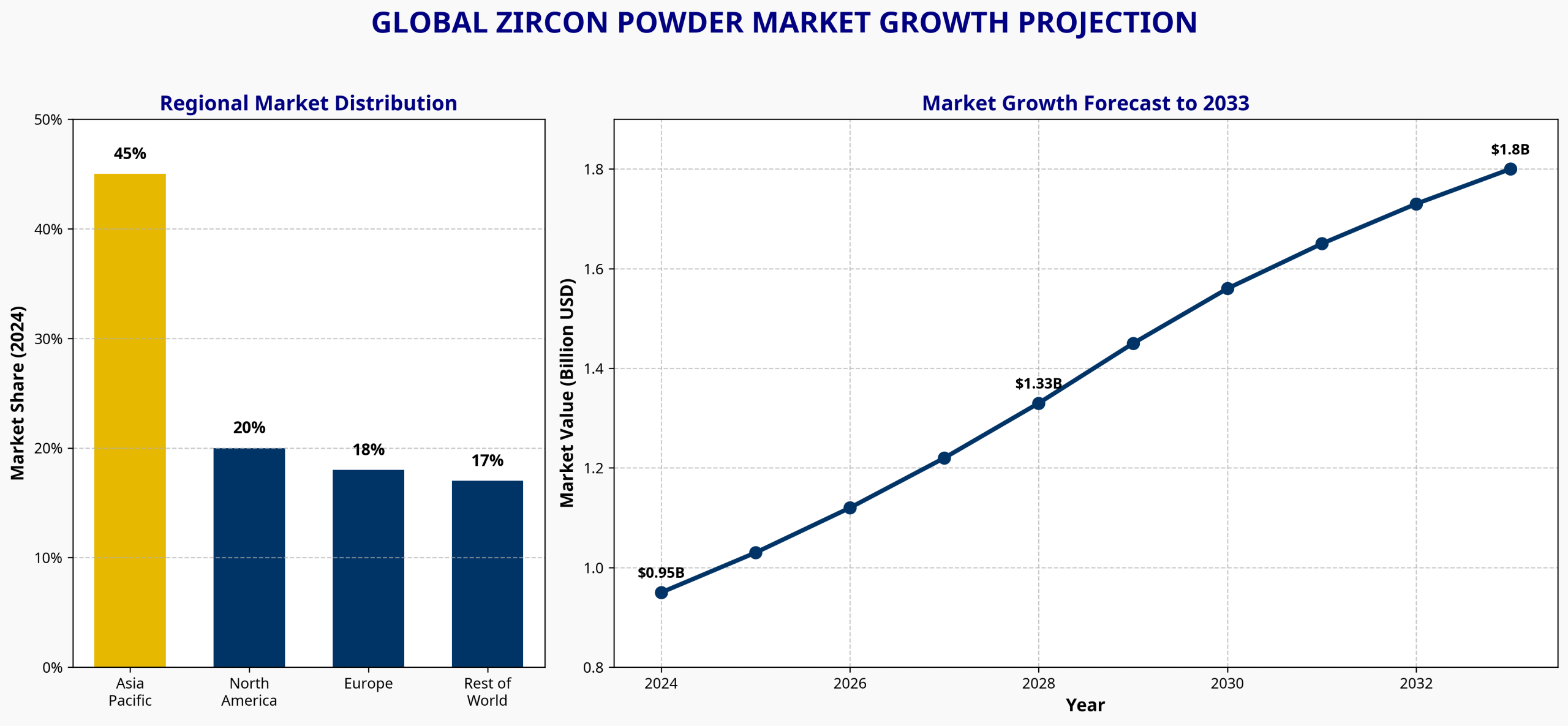

The global zircon powder market currently stands at approximately $0.95 billion as of 2024, representing a specialized but rapidly expanding segment within the broader industrial minerals sector. The zircon powder market has demonstrated resilient growth despite recent global economic challenges, maintaining a steady compound annual growth rate (CAGR) of 6.4-7.1% over the past five years, positioning it for continued expansion through 2033.

Regional distribution of zircon powder market share reveals Asia-Pacific’s dominance, accounting for approximately 45% of global consumption. This regional leadership is primarily driven by China’s massive ceramics industry and expanding electronics manufacturing base. North America and Europe follow with approximately 20% and 18% market share respectively, while emerging markets in Latin America, Middle East, and Africa collectively represent the remaining 17% of the global zircon powder market.

Key zircon powder market players exhibit moderate concentration, with the top five producers controlling approximately 60% of global supply. These include Iluka Resources (Australia), Rio Tinto (Australia), Tronox Holdings (USA), Kenmare Resources (Ireland), and Chemours (USA). The remaining market comprises numerous medium and small-scale processors specializing in high-purity grades for specific applications, all contributing to the projected zircon powder market growth through 2033.

Recent zircon powder market performance indicates accelerating growth, with a 9.2% year-over-year increase in 2023-2024, significantly outpacing the 5.8% average growth observed during the previous three-year period. This acceleration stems from post-pandemic industrial recovery and increasing adoption in high-tech applications, further supporting projections for zircon powder market growth to 2033.

| Market Aspect | Current Value (2024) | Projected Value (2033) | CAGR |

|---|---|---|---|

| Global Zircon Powder Market Size | $0.95 billion | $1.8 billion | 7.3% |

| Production Volume | 1.2 million tons | 2.1 million tons | 6.4% |

| Average Price | $790/ton | $857/ton | 0.9% |

| Asia-Pacific Share | 45% | 52% | 8.5% |

| High-Purity Grade Segment | $0.38 billion | $0.83 billion | 9.1% |

Current production capacity utilization rates average 78% globally, indicating room for expansion without significant new capital investments to support zircon powder market growth. However, regional disparities exist, with Asian facilities operating at near-capacity (92%) while North American operations maintain more conservative utilization rates (65-70%) to ensure flexibility in responding to demand fluctuations through 2033.

Which Industries Are Fueling Zircon Powder Demand?

The ceramic industry remains the primary consumer of zircon powder, accounting for approximately 54% of total demand in the global zircon powder market. Within ceramics, the material serves as a critical opacifier and whitening agent in glazes and as a key component in high-performance ceramic bodies. The ongoing construction boom in developing economies, particularly in Asia, continues to drive ceramic tile and sanitaryware production, directly increasing zircon powder consumption and contributing to market growth through 2033.

Electronics and semiconductor applications represent the fastest-growing segment of the zircon powder market, currently comprising 15% of market demand but expanding at a CAGR of 11.3%. Zircon-based materials are increasingly utilized in advanced ceramic capacitors, piezoelectric devices, and specialized semiconductor packaging solutions. The miniaturization trend in electronics and the expansion of 5G infrastructure are accelerating demand for high-purity zircon derivatives, significantly impacting zircon powder market growth projections to 2033.

The foundry and refractory sector constitutes approximately 18% of current zircon powder market consumption. Zircon flour and sand serve as essential mold coatings and core washes in precision metal casting, particularly for aerospace and automotive components. The material’s high temperature stability and non-wetting characteristics with molten metals make it irreplaceable in these applications. The sector’s growth correlates strongly with manufacturing output in high-value engineering industries, further driving zircon powder market growth through 2033.

| Industry Sector | Current Market Share (2024) | Projected Share (2033) | Growth Drivers |

|---|---|---|---|

| Ceramics | 54% | 48% | Construction activity, premium tile demand |

| Electronics | 15% | 23% | 5G rollout, miniaturization, EV production |

| Foundry/Refractory | 18% | 15% | Aerospace, automotive manufacturing |

| Medical/Dental | 8% | 10% | Aging population, dental implant adoption |

| Others | 5% | 4% | Specialized applications |

The medical and dental industries, while representing a smaller 8% of current zircon powder market demand, demonstrate premium value potential with average selling prices 3-4 times higher than standard grades. Zirconia derived from high-purity zircon powder has become the material of choice for dental implants, crowns, and certain orthopedic applications due to its biocompatibility, strength, and aesthetic qualities. The aging global population and increasing dental procedure rates in developing economies suggest sustained growth in this segment of the zircon powder market through 2033.

Emerging applications in nuclear power, catalysts, and advanced materials collectively account for the remaining 5% of zircon powder market demand. While relatively small in volume, these specialized applications often command premium pricing and represent potential breakthrough growth areas as technological adoption accelerates, potentially reshaping zircon powder market growth projections for 2033.

How Are Supply Chain Dynamics Affecting Market Growth?

The zircon powder supply chain begins with mineral sand mining operations concentrated in Australia (30% of global production), South Africa (25%), China (15%), and other countries including Mozambique, Kenya, and Vietnam. These geographic concentrations create inherent supply vulnerabilities in the zircon powder market, as evidenced by the 18% price spike following temporary mine closures in South Africa during 2022, which could impact long-term market growth through 2033.

Processing and refining capacity is more widely distributed, with significant operations in China, the United States, France, Japan, and India. However, high-purity processing remains concentrated in developed economies due to the sophisticated technology and quality control requirements. This processing stage represents the primary bottleneck in the zircon powder market supply chain, with capacity expansion typically requiring 2-3 years from investment decision to operational status, potentially constraining market growth toward 2033.

Transportation and logistics challenges have emerged as significant factors affecting zircon powder market growth. Shipping costs for zircon materials increased by 185% between 2020 and 2022, though they have subsequently moderated to approximately 60% above pre-pandemic levels. These elevated costs disproportionately impact cross-regional trade, creating advantages for vertically integrated producers with localized supply chains and influencing regional zircon powder market growth patterns through 2033.

Regional supply-demand imbalances persist in the zircon powder market, with Asia experiencing a 120,000-ton annual deficit while North America maintains a 45,000-ton surplus. These imbalances drive international trade flows and influence regional pricing dynamics. The Asia-Pacific deficit is projected to widen to 180,000 tons by 2028 unless significant new processing capacity is developed in the region, potentially reshaping zircon powder market growth trajectories toward 2033.

| Supply Chain Element | Current Challenge | Market Impact | Mitigation Strategies |

|---|---|---|---|

| Mining Operations | Concentrated in few countries | Supply vulnerability | Long-term contracts, strategic reserves |

| Processing Capacity | Limited high-purity capability | Premium grade shortages | Vertical integration, technology investment |

| Transportation | Elevated shipping costs | Regional price disparities | Localized supply chains, inventory management |

| Inventory Management | Reduced buffer stocks | Price volatility | Just-in-time delivery systems, forecasting |

| Environmental Compliance | Increasing regulations | Rising production costs | Process optimization, sustainable practices |

Inventory management strategies have evolved significantly in the zircon powder market, with average industry inventory levels declining from 3.5 months of consumption in 2019 to 1.8 months in 2024. This reduction reflects both improved supply chain efficiency and financial optimization but increases vulnerability to supply disruptions that could impact zircon powder market growth through 2033. Leading consumers have responded by developing strategic supplier relationships and implementing sophisticated demand forecasting systems to ensure stable market growth.

What Technological Innovations Are Transforming the Market?

Advanced processing techniques have revolutionized zircon powder production, with high-energy milling and chemical purification methods enabling the consistent production of sub-micron particles with controlled morphology. These technological advances have expanded the material’s application range while improving performance in existing uses. The premium commanded by ultra-fine grades has increased from 35% to 65% over standard grades in the past five years, significantly influencing zircon powder market growth projections through 2033.

Nano-zirconia powder developments represent perhaps the most significant technological frontier in the zircon powder market, with particles below 100 nanometers exhibiting unique properties valuable in catalysts, sensors, and biomedical applications. Commercial production of nano-zirconia has grown at 28% annually since 2020, albeit from a small base, and is projected to become a $120 million sub-segment by 2030, contributing to overall zircon powder market growth toward 2033.

Sustainable and eco-friendly production methods are gaining traction in the zircon powder market in response to regulatory pressures and corporate sustainability initiatives. Innovations include closed-loop water systems reducing freshwater consumption by up to 85%, energy-efficient milling techniques lowering carbon footprints by 30-40%, and advanced separation technologies minimizing chemical usage. These improvements not only address environmental concerns but also frequently reduce operating costs, supporting sustainable zircon powder market growth through 2033.

| Technological Innovation | Market Impact | Adoption Timeline | Leading Developers |

|---|---|---|---|

| High-Energy Milling | Enables sub-micron powders | Widely adopted | Tosoh (Japan), Saint-Gobain (France) |

| Nano-Zirconia Production | Creates new application possibilities | Early commercial stage | Daiichi Kigenso (Japan), Tosoh (Japan) |

| Chemical Purification | Achieves 99.9%+ purity | Established technology | Chemours (USA), Tronox (USA) |

| Sustainable Processing | Reduces environmental impact | Increasing adoption | Iluka Resources (Australia), Rio Tinto (Australia) |

| Digital Quality Control | Ensures consistent specifications | Rapid implementation | Various equipment manufacturers |

Automation and digitalization have transformed manufacturing processes in the zircon powder market, with advanced optical sorting, laser particle analysis, and AI-driven process control systems ensuring unprecedented consistency in powder characteristics. These technologies have reduced quality variation by approximately 65% since 2015, enabling more demanding applications and reducing waste rates in downstream manufacturing, further supporting zircon powder market growth projections to 2033.

Quality control innovations have been particularly impactful for zircon powder market growth, with real-time monitoring systems capable of detecting sub-ppm contaminants and ensuring precise particle size distributions. These capabilities have been essential in meeting the increasingly stringent requirements of electronic and medical applications, where performance tolerances continue to narrow as technology advances, driving premium segment growth in the zircon powder market through 2033.

Why Are Pricing Trends Critical to Market Expansion?

Historical pricing analysis reveals moderate volatility in zircon powder markets, with standard grades experiencing price fluctuations of ±22% around the long-term trend line over the past decade. This volatility primarily stems from supply disruptions rather than demand fluctuations, as evidenced by the 35% price spike following Australian mining restrictions in 2017-2018 and the subsequent normalization as alternative sources increased production, factors that will continue to influence zircon powder market growth through 2033.

Raw material cost influences dominate pricing structures in the zircon powder market, with zircon sand typically representing 65-75% of finished powder production costs. Energy costs constitute the second largest component at 10-15%, followed by labor, transportation, and other inputs. The correlation between raw zircon prices and finished powder prices exceeds 0.85, indicating limited ability for processors to absorb input cost fluctuations, a key consideration for zircon powder market growth projections to 2033.

Regional price differentials create significant arbitrage opportunities in the zircon powder market, with Asian markets typically commanding a 12-18% premium over North American prices due to the regional supply deficit. European prices generally fall between these extremes, averaging 5-8% above North American levels. These differentials have narrowed somewhat in recent years as improved logistics and increased competition have created more efficient global markets, potentially accelerating zircon powder market growth through 2033.

| Price Category | 2020 Average | 2024 Average | 2033 Projection | Key Influencing Factors |

|---|---|---|---|---|

| Standard Grade | $720/ton | $790/ton | $857/ton | Mining output, energy costs |

| Premium Grade | $1,150/ton | $1,380/ton | $1,620/ton | Technical requirements, application growth |

| Ultra-High Purity | $2,800/ton | $3,450/ton | $4,200/ton | Electronics demand, processing capacity |

| Regional Premium (Asia) | +15% | +12% | +8% | Supply-demand balance, shipping costs |

| Price Volatility | ±18% | ±22% | ±15% | Supply diversification, contract structures |

Premium versus standard grade pricing strategies have evolved significantly in the zircon powder market, with the market increasingly segmented by application requirements. The premium for high-purity grades (99.5%+) has expanded from 45% in 2015 to 75% in 2024, reflecting both increased production costs and greater value recognition in demanding applications. This trend is expected to continue, with the premium potentially reaching 90% by 2030, reshaping zircon powder market growth patterns through 2033.

Price elasticity of demand varies dramatically across zircon powder market application segments. Ceramic applications demonstrate relatively high elasticity (-0.8 to -1.2), with substitution occurring when prices rise significantly. In contrast, electronic and medical applications show much lower elasticity (-0.2 to -0.4), reflecting the lack of viable alternatives and the small contribution of zircon materials to overall product costs in these high-value applications, factors that will influence zircon powder market growth through 2033.

How Are Regulatory and Sustainability Factors Shaping the Industry?

Environmental regulations affecting mining and processing have tightened significantly in the zircon powder market, with particular focus on water usage, tailings management, and habitat restoration. Australia’s Mineral Sands Mining Code of Practice, implemented in 2021, has become a de facto global standard, requiring comprehensive environmental impact assessments and detailed restoration plans. Compliance costs have increased mining operational expenses by an estimated 12-18% but have improved long-term sustainability of the zircon powder market through 2033.

Worker safety standards have similarly evolved in the zircon powder market, particularly regarding dust exposure and radiation protection. Zircon naturally contains trace amounts of uranium and thorium, necessitating monitoring and control measures throughout the supply chain. The International Atomic Energy Agency’s 2023 guidelines for NORM (Naturally Occurring Radioactive Materials) have standardized practices globally, creating more predictable compliance requirements across jurisdictions that will influence zircon powder market growth through 2033.

Radiation safety protocols represent a specialized regulatory area affecting zircon powder production and handling. While radiation levels in finished powders are typically well below hazardous thresholds, processing concentrates radioactive elements, requiring monitoring and controlled disposal of certain waste streams. These requirements add approximately 3-5% to production costs but are essential for regulatory compliance and worker protection in the zircon powder market through 2033.

| Regulatory Factor | Geographic Impact | Cost Implication | Industry Response |

|---|---|---|---|

| Environmental Regulations | Most stringent in Australia, EU | +12-18% mining costs | Improved recovery rates, sustainable practices |

| Worker Safety Standards | Global harmonization increasing | +5-8% processing costs | Automation, engineering controls |

| Radiation Protocols | Varies by jurisdiction | +3-5% production costs | Monitoring systems, waste management |

| Sustainability Initiatives | Led by EU, spreading globally | Variable implementation costs | Marketing advantage, efficiency improvements |

| Product Certification | Most demanding in medical, electronics | Quality system investments | Price premiums, market access |

Sustainability initiatives increasingly influence customer purchasing decisions in the zircon powder market, particularly among large multinational corporations with public environmental commitments. The zircon industry has responded with voluntary sustainability reporting, carbon footprint reduction programs, and responsible sourcing certifications. Leading producers have achieved 15-25% reductions in carbon emissions per ton of product since 2018, primarily through energy efficiency improvements and renewable energy adoption, supporting sustainable zircon powder market growth through 2033.

Certification and quality standards have proliferated in the zircon powder market, with application-specific requirements creating complex compliance landscapes. Medical-grade zircon products must meet ISO 13485 standards, electronic grades typically require ISO 9001 plus customer-specific certifications, and even standard ceramic grades increasingly require environmental compliance documentation. These requirements create barriers to entry but also enable premium pricing for fully certified materials, influencing zircon powder market growth projections to 2033.

What Regional Growth Patterns Will Emerge Through 2033?

Asia-Pacific dominance in the zircon powder market is projected to strengthen, with the region’s share of global consumption increasing from 45% currently to approximately 52% by 2033. This growth is driven by continued expansion of ceramic manufacturing in China, India, and Southeast Asia, coupled with the region’s accelerating electronics production. China alone is expected to account for 35% of global zircon powder consumption by 2033, significantly shaping overall market growth.

North American zircon powder market resilience stems from the region’s focus on high-value applications in aerospace, medical, and advanced electronics. While volume growth is projected at a modest 4.2% CAGR, value growth will reach 6.8% as the product mix continues shifting toward premium grades. The region’s consumption is expected to reach approximately 280,000 tons valued at $310 million by 2033, contributing to global zircon powder market growth.

European markets demonstrate a pronounced focus on high-purity and technical grade powders, with standard ceramic grades representing only 38% of consumption compared to the global average of 54%. This specialization is expected to continue, with Europe maintaining approximately 18% of global zircon powder market value while accounting for only 14% of volume by 2033. Stringent environmental regulations will continue driving adoption of higher-performance, longer-lasting materials despite their premium pricing, influencing regional zircon powder market growth patterns.

| Region | Current Market Share (2024) | Projected Share (2033) | Key Growth Drivers | Challenges |

|---|---|---|---|---|

| Asia-Pacific | 45% | 52% | Ceramic production, electronics | Raw material access, environmental regulations |

| North America | 20% | 17% | High-tech applications, medical | Competition from alternative materials |

| Europe | 18% | 16% | Premium applications, sustainability | Energy costs, regulatory compliance |

| Middle East & Africa | 10% | 9% | Construction growth, local processing | Political instability, infrastructure limitations |

| Latin America | 7% | 6% | Ceramic sector expansion | Economic volatility, logistics challenges |

Emerging markets in the Middle East and Africa present contrasting opportunities for zircon powder market growth. The Middle East is developing as a processing hub due to low energy costs and strategic location between mineral sources and Asian markets. Meanwhile, African nations with zircon deposits, particularly Mozambique, Kenya, and Madagascar, are implementing policies to encourage local value-addition rather than raw material export, potentially creating new processing centers by the late 2020s that will influence zircon powder market growth through 2033.

Latin American production potential remains significant but underutilized in the zircon powder market. Brazil possesses substantial zircon resources but has developed limited processing capacity, currently operating at approximately 35% of potential. Regional consumption is primarily driven by the Brazilian and Mexican ceramic industries, with growth projected at 5.3% CAGR through 2033, slightly below the global average for zircon powder market growth.

Which Strategic Investments Will Define Market Leadership?

Capacity expansion projects represent the most visible strategic investments in the zircon powder market, with announced additions totaling approximately 180,000 tons of annual production capacity to be implemented between 2025 and 2028. These expansions are concentrated in China (85,000 tons), India (45,000 tons), and Vietnam (30,000 tons), reflecting the shift of processing capacity toward consumption centers. The timeline impact of these investments will begin materializing in late 2026, potentially moderating price increases in standard grades and supporting zircon powder market growth through 2033.

Vertical integration strategies have accelerated among key players in the zircon powder market, with mining companies expanding into processing and processors securing dedicated mineral supplies. This integration provides greater supply security, margin capture, and market influence. The percentage of zircon sand production controlled by vertically integrated companies has increased from 35% in 2015 to 58% in 2024 and is projected to reach 65% by 2030, reshaping competitive dynamics in the zircon powder market through 2033.

R&D investments in specialty and high-performance powders have intensified in the zircon powder market, with the top five producers collectively increasing research spending by 45% between 2020 and 2024. These investments focus on nano-scale powders, surface-modified variants, and ultra-high-purity grades for emerging applications. The innovation pipeline suggests commercial introduction of at least seven significant new product variants by 2027, potentially creating new market segments and accelerating zircon powder market growth toward 2033.

| Strategic Investment | Leading Companies | Expected Impact | Implementation Timeline |

|---|---|---|---|

| Capacity Expansion | Chinese processors, Iluka Resources | Supply increase, regional balance | 2025-2028 |

| Vertical Integration | Rio Tinto, Tronox, Kenmare | Supply security, margin improvement | Ongoing |

| R&D in Specialty Powders | Tosoh, Daiichi Kigenso, Saint-Gobain | New applications, premium pricing | 2025-2030 |

| Strategic Acquisitions | Larger processors, investment firms | Market consolidation | Accelerating |

| Distribution Networks | All major producers | Market access, customer relationships | Continuous development |

Strategic acquisitions and consolidation patterns indicate an industry in transition, with 12 significant transactions completed since 2020 in the zircon powder market. These range from mining asset acquisitions to processing technology purchases and distribution network expansions. The trend suggests continued consolidation, with the market share of the top five producers potentially increasing from 60% currently to 70-75% by 2030, significantly influencing zircon powder market growth through 2033.

Distribution network development in high-growth regions has become a competitive differentiator in the zircon powder market, particularly for producers targeting specialized applications. Technical service capabilities, local inventory availability, and application development support increasingly complement product quality and pricing in purchasing decisions. Leading companies have expanded their technical service teams by 30-40% since 2020, particularly in Asia and emerging markets, positioning themselves to capitalize on zircon powder market growth through 2033.

FAQ Section

Q1: What makes zircon powder critical for modern industries?

Zircon powder is essential due to its exceptional properties: high temperature resistance (up to 2,200°C), chemical inertness, and mechanical stability. It provides opacity and hardness in ceramics, dielectric properties for electronics, thermal stability for foundries, and biocompatibility for medical applications. These unique properties create a material with few substitutes across critical manufacturing sectors.

Q2: How volatile will zircon powder pricing be through 2033?

Moderate volatility is expected with 8-12% annual price fluctuations. Key factors include concentrated supply (Australia, South Africa, China control 70%+ of production), cyclical construction demand, and energy cost variations. Long-term contracts and strategic reserves should provide some price stabilization, with premium grades experiencing less volatility than standard grades.

Q3: What technological challenges must be overcome to meet 2033 demand?

Key challenges include: improving processing efficiency to reduce 30-40% energy consumption, advancing impurity removal to achieve sub-100ppm contamination levels, refining particle size control for nano-scale applications, developing sustainable processing to reduce 2.5 tons waste per ton output, and implementing automation for consistent quality while reducing labor intensity.

Q4: How will environmental regulations impact the supply chain?

Regulations will add 15-20% to production costs in strictly regulated regions. Mining faces tighter restrictions on land rehabilitation and water usage, while processing facilities must address emissions and radioactive elements. However, companies investing in closed-loop systems, dry processing, and renewable energy may gain competitive advantages.

Q5: Which emerging applications could disrupt current market growth projections?

Several emerging applications could significantly alter the zircon powder market trajectory through 2033. Solid oxide fuel cells represent a potential high-volume, high-value application that could add $150-200 million to market size if commercialization accelerates. Advanced thermal barrier coatings for next-generation jet engines and industrial turbines could increase demand for specialized high-purity grades by 25-30%. 3D printing of ceramic components using zirconia-based materials is growing at 35% annually, potentially creating a $120 million sub-market by 2033. Additionally, environmental remediation technologies using zircon-based adsorbents for heavy metal removal show promise for creating new demand streams not currently factored into zircon powder market growth projections for 2033.