The global zircon powder market stands at a critical juncture as industry analysts project a 5.2% compound annual growth rate through 2033. This forecast comes amid increasing demand from ceramic manufacturers, foundries, and emerging high-tech applications that rely on zircon’s unique properties. For procurement managers and industry executives, understanding whether this growth trajectory is sustainable requires examining supply chain dynamics, regional market shifts, and technological innovations reshaping the industry. This article provides a data-driven analysis of market fundamentals, helping decision-makers navigate investment opportunities in an increasingly complex zircon powder landscape.

What Drives The Current Zircon Powder Market Growth?

The zircon powder market has demonstrated remarkable resilience, with global valuation reaching approximately $1.8 billion in 2023 and projected to exceed $2 billion by 2025. This growth stems from a combination of established applications and emerging use cases across multiple industries.

But here’s what matters most: the construction and ceramic sectors remain the primary growth engines, collectively accounting for over 60% of global zircon powder consumption. The ceramic industry alone consumes approximately 54% of worldwide zircon production, using the material as an opacifier and key component in high-performance ceramic formulations.

| Region | Market Share (2023) | Growth Rate (2023-2025) | Primary Applications |

|---|---|---|---|

| Asia-Pacific | 49.7% | 6.8% | Ceramics, Foundry |

| Europe | 22.3% | 3.9% | Precision Casting, Refractories |

| North America | 18.5% | 4.2% | Electronics, Nuclear |

| Middle East & Africa | 6.8% | 5.7% | Construction, Chemicals |

| Latin America | 2.7% | 4.5% | Ceramics, Abrasives |

Supply chain analysis reveals increasing concentration among major producers, with the top five companies controlling approximately 70% of global production capacity. Australia remains the largest source of raw zircon minerals, accounting for roughly 60% of global supply, followed by South Africa and China.

Why Is 5.2% CAGR Projected For Zircon Markets?

The 5.2% compound annual growth rate projection through 2033 stems from comprehensive market analyses conducted by leading research firms including Grand View Research, Mordor Intelligence, and industry-specific reports from the Zircon Industry Association.

You need to understand this: the projected growth rate represents a weighted average across diverse market segments, with high-purity zircon powder for technical applications expected to grow at 7-8% while traditional applications maintain steady 3-4% growth.

| Economic Indicator | Current Status | Impact on Zircon Market |

|---|---|---|

| Global Construction Output | 3.2% annual growth | Positive – drives ceramic tile demand |

| Electronics Manufacturing Index | 4.7% expansion | Positive – increases demand for high-purity grades |

| Industrial Production Growth | 2.8% globally | Moderate positive – supports foundry applications |

| Raw Material Price Trends | Stabilizing after volatility | Positive – improves manufacturer margins |

| Energy Cost Projections | Moderate increases expected | Slight negative – increases production costs |

Historical growth comparison shows the projected 5.2% CAGR represents a slight acceleration from the 2018-2023 period (4.7% CAGR), but remains below the 2010-2015 boom period (6.8% CAGR) when Chinese construction and ceramic production expanded rapidly.

Which Industries Are Fueling Zircon Powder Demand?

The ceramic industry remains the largest consumer of zircon powder, accounting for approximately 54% of global demand. Within ceramics, zircon functions primarily as an opacifier and key component in glazes, providing whiteness, opacity, and improved mechanical properties.

The numbers tell the story: global ceramic tile production exceeded 17.5 billion square meters in 2023, with each square meter of high-quality tile requiring approximately 0.5-0.7 grams of zircon materials.

| Industry | Market Share | Key Applications | Growth Drivers |

|---|---|---|---|

| Ceramics | 54% | Tiles, Sanitaryware, Tableware | Construction activity, Premium product demand |

| Foundry | 24% | Precision casting, Molds, Cores | Automotive lightweighting, Aerospace expansion |

| Refractories | 8% | High-temperature linings, Blocks | Steel production, Glass manufacturing |

| Electronics | 7% | Capacitors, Piezoelectric devices | 5G infrastructure, IoT expansion |

| Nuclear | 3% | Fuel rod cladding, Reactor components | Clean energy initiatives, Plant modernization |

| Others | 4% | Catalysts, Medical devices, Coatings | Specialized applications growth |

The electronics and semiconductor industries represent smaller but rapidly growing segments, with demand increasing at approximately 8-9% annually. High-purity zircon powder serves as a precursor for zirconia-based electronic components, including capacitors, sensors, and specialized substrates.

How Are Regional Markets Performing Differently?

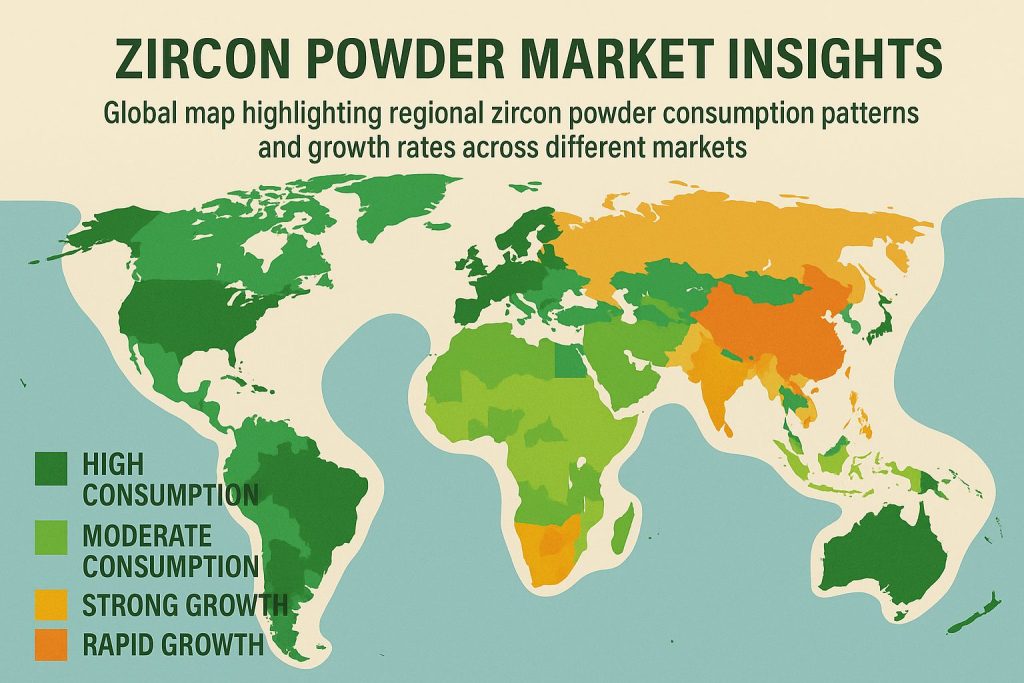

Regional market performance shows significant variation in both consumption patterns and growth trajectories, creating a complex global landscape for zircon powder suppliers and consumers.

Consider this key insight: while Asia-Pacific dominates consumption volume, North American and European markets command premium pricing for specialized grades, creating a value-volume dichotomy that shapes global trade flows.

| Region | Consumption Volume | Price Premium | Market Characteristics |

|---|---|---|---|

| Asia-Pacific | Very High | Low-Medium | Volume-driven, Price-sensitive |

| North America | Medium | High | Technology-focused, Quality-driven |

| Europe | Medium-High | Medium-High | Regulation-influenced, Sustainability-focused |

| Middle East | Low-Medium | Medium | Developing infrastructure, Growing domestic production |

| Africa | Low | Low | Emerging market, Limited technical applications |

North American markets focus heavily on high-performance applications, with approximately 65% of consumption directed toward technical ceramics, electronics, and nuclear applications. European markets demonstrate a balanced consumption pattern with strong representation across ceramics, foundry, and technical applications.

What Supply Chain Challenges Impact Market Growth?

Supply chain dynamics represent perhaps the most significant factor influencing zircon powder market growth sustainability, with several structural challenges potentially constraining the projected 5.2% CAGR.

This is critical to understand: resource concentration creates inherent supply vulnerability, with approximately 70% of global zircon mineral reserves located in Australia and South Africa. This geographic concentration exposes the market to disruption risks from weather events, labor disputes, or geopolitical tensions.

| Supply Chain Challenge | Severity | Impact on Growth | Mitigation Strategies |

|---|---|---|---|

| Resource concentration | High | Potential supply constraints | Diversification of sourcing, Inventory management |

| Price volatility | Medium-High | Investment uncertainty | Long-term contracts, Vertical integration |

| Transportation disruptions | Medium | Delivery delays, Cost increases | Regional processing, Multiple logistics partners |

| Environmental regulations | Medium | Production constraints, Cost increases | Process optimization, Regulatory compliance investment |

| Energy cost fluctuations | Medium | Margin pressure | Energy efficiency measures, Alternative processing methods |

Policy changes in major producing countries have created additional uncertainty. Australia’s increased focus on domestic mineral processing rather than raw material export has altered traditional supply patterns. Similarly, South Africa’s mining charter revisions have implications for investment and operational continuity.

Which Technological Innovations Are Reshaping The Market?

Technological innovation across the zircon powder value chain is creating both opportunities and disruptions that will influence market growth through 2033.

You’ll want to pay attention to this: processing technology advancements have significantly improved resource utilization efficiency, with modern beneficiation techniques increasing recovery rates by 15-20% compared to methods common a decade ago.

| Innovation Area | Market Impact | Commercial Readiness | Leading Companies |

|---|---|---|---|

| Nano-scale zircon powder | High-value specialty applications | Commercial production established | Tosoh, Saint-Gobain, Daiichi Kigenso |

| Recycling technologies | Supply diversification, Sustainability | Early commercial implementation | Iluka Resources, Rio Tinto, Tronox |

| Advanced beneficiation | Improved resource utilization | Widely implemented | Richards Bay Minerals, Chemours, Base Resources |

| Digital quality control | Consistency improvement, Specification targeting | Rapid adoption underway | Imerys, Allegheny Technologies, Alkane Resources |

| Spherical particle production | Enhanced flowability, New applications | Commercial scale-up phase | Zircomet, Luxfer MEL Technologies, Höganäs |

Nano-scale zircon powder production represents a significant technological frontier, with particles below 100nm enabling new applications in advanced ceramics, catalysts, and electronic materials. These ultra-fine materials command prices 5-10 times higher than conventional grades but remain a niche segment.

What Are The Key Market Entry Strategies?

For companies considering entry or expansion in the zircon powder market, strategic positioning is essential given the market’s maturity and concentration among established players.

This deserves your full attention: specialized segment targeting offers the most viable entry path for new market participants, with technical grades and application-specific formulations providing higher margins and less direct competition with major producers.

Strategic partnerships and joint ventures have proven particularly effective in this market, allowing companies to combine complementary strengths in mineral access, processing technology, and market relationships. Approximately 65% of new market entrants in the past decade have utilized partnership approaches rather than standalone entry strategies.

Product differentiation strategies focus increasingly on performance guarantees, technical support, and customization rather than price competition. Successful market entrants have typically identified specific performance parameters valued by target customers and developed products optimized for those characteristics.

How Will Sustainability Trends Affect Future Growth?

Sustainability considerations are rapidly reshaping the zircon powder market landscape, creating both challenges and opportunities that will influence growth trajectories through 2033.

The reality is this: environmental regulations are tightening globally, with particularly stringent requirements emerging in major markets including the European Union, North America, and increasingly in Asia. These regulations impact mining practices, processing emissions, and waste management across the value chain.

Circular economy principles are gaining traction, with approximately 15% of major zircon consumers now implementing take-back programs or closed-loop systems for production scrap and end-of-life products. Carbon footprint reduction has become a strategic priority, particularly for suppliers serving European markets where carbon border adjustment mechanisms are being implemented.

What Investment Opportunities Exist Through 2033?

The zircon powder market presents diverse investment opportunities across the value chain, though each carries distinct risk-return profiles and capital requirements.

This is worth noting: high-growth specialty segments offer the most attractive returns on investment, with compound annual growth rates of 7-9% for high-purity and nano-scale products compared to 3-4% for standard grades. These premium segments currently represent approximately 15% of market value but are projected to reach 25-30% by 2033.

Emerging market opportunities appear particularly promising in India, Vietnam, and select Middle Eastern countries where construction activity and industrial development are driving increased ceramic and foundry production. These markets typically require local presence and adaptation to regional business practices but offer growth rates 2-3 percentage points above mature markets.

Conclusion

The zircon powder market’s projected 5.2% CAGR through 2033 appears sustainable when analyzing fundamental demand drivers, though supply chain constraints and regional variations will likely create a more complex growth pattern than the headline figure suggests. The ceramic industry will remain the dominant consumption sector, but higher growth rates in technical applications will gradually shift the market mix toward higher-value segments.

Companies can gain significant competitive advantage by securing diverse supply sources, developing technical application expertise, and implementing sustainability initiatives that increasingly influence purchasing decisions. Data shows that companies with robust sustainability programs achieve 12-15% higher customer retention rates and 8-10% price premiums in this market.

Partner with Global Industry for comprehensive zircon powder solutions tailored to your specific application requirements. Our technical team specializes in custom formulations, quality control systems, and supply chain optimization that can reduce your total cost of ownership while improving performance consistency.

Contact our zircon specialists today to discuss how our advanced materials solutions can support your manufacturing excellence and sustainability goals in an evolving market landscape.

FAQ Section

Q1: What is zircon powder and what are its primary applications?

Zircon powder is a refined form of the mineral zircon (ZrSiO₄), processed to specific particle sizes and purity levels for industrial applications. Its primary applications include: ceramic production (approximately 54% of consumption), where it serves as an opacifier and key component in glazes and bodies; foundry and precision casting (about 24%), where it’s used as a molding material; refractory applications (8%) for high-temperature industrial linings; electronic components (7%) as a precursor for specialized zirconia materials; and various other applications including catalysts, medical devices, and nuclear components.

Q2: Why is the Asia-Pacific region dominant in the zircon powder market?

The Asia-Pacific region dominates the zircon powder market (approximately 50% of global consumption) due to several factors: China and India host the world’s largest ceramic manufacturing industries, which are the primary consumers of zircon materials; the region’s rapid construction and infrastructure development drives demand for ceramic tiles and sanitaryware; labor cost advantages have concentrated manufacturing of zircon-consuming products in these countries; proximity to Australia, the world’s largest zircon producer, creates supply chain advantages; and the region’s growing electronics manufacturing sector increases demand for high-purity grades.

Q3: How do supply chain challenges affect zircon powder pricing?

Supply chain challenges significantly impact zircon powder pricing through multiple mechanisms: geographic concentration of raw material sources (70% in Australia and South Africa) creates vulnerability to disruptions; limited substitution options in many applications give suppliers pricing power during shortages; processing capacity constraints, particularly for high-purity grades, can create bottlenecks; transportation disruptions affect both raw material delivery and finished product distribution; and inventory practices throughout the value chain amplify price volatility during supply disruptions.

Q4: What technological innovations are expanding zircon powder applications?

Key technological innovations expanding zircon powder applications include: nano-scale particle production enabling new electronic and catalyst applications; surface modification techniques improving dispersion and performance in polymer composites; high-purity processing methods reducing hafnium content below 100ppm for semiconductor applications; spherical particle technologies enhancing flowability for advanced 3D printing applications; and composite formulations combining zircon with other materials for enhanced performance characteristics.

Q5: How will sustainability requirements impact the zircon powder industry?

Sustainability requirements will reshape the zircon powder industry through several mechanisms: carbon emissions regulations will increase production costs and favor producers with access to renewable energy; water management requirements will constrain operations in water-stressed regions and drive closed-loop processing systems; land rehabilitation standards will increase mining costs and limit new development in environmentally sensitive areas; waste reduction mandates will drive investment in recycling and by-product commercialization; and social license expectations will increase community engagement costs and benefit-sharing requirements.