The global zirconia market is experiencing significant growth, with multiple factors driving this trend through 2030. As an advanced ceramic material, zirconia plays an increasingly important role in medical, electronic, industrial, and energy sectors due to its exceptional physical and chemical properties. This article analyzes the key factors driving global zirconia market growth, offering a comprehensive perspective for industry participants and investors.

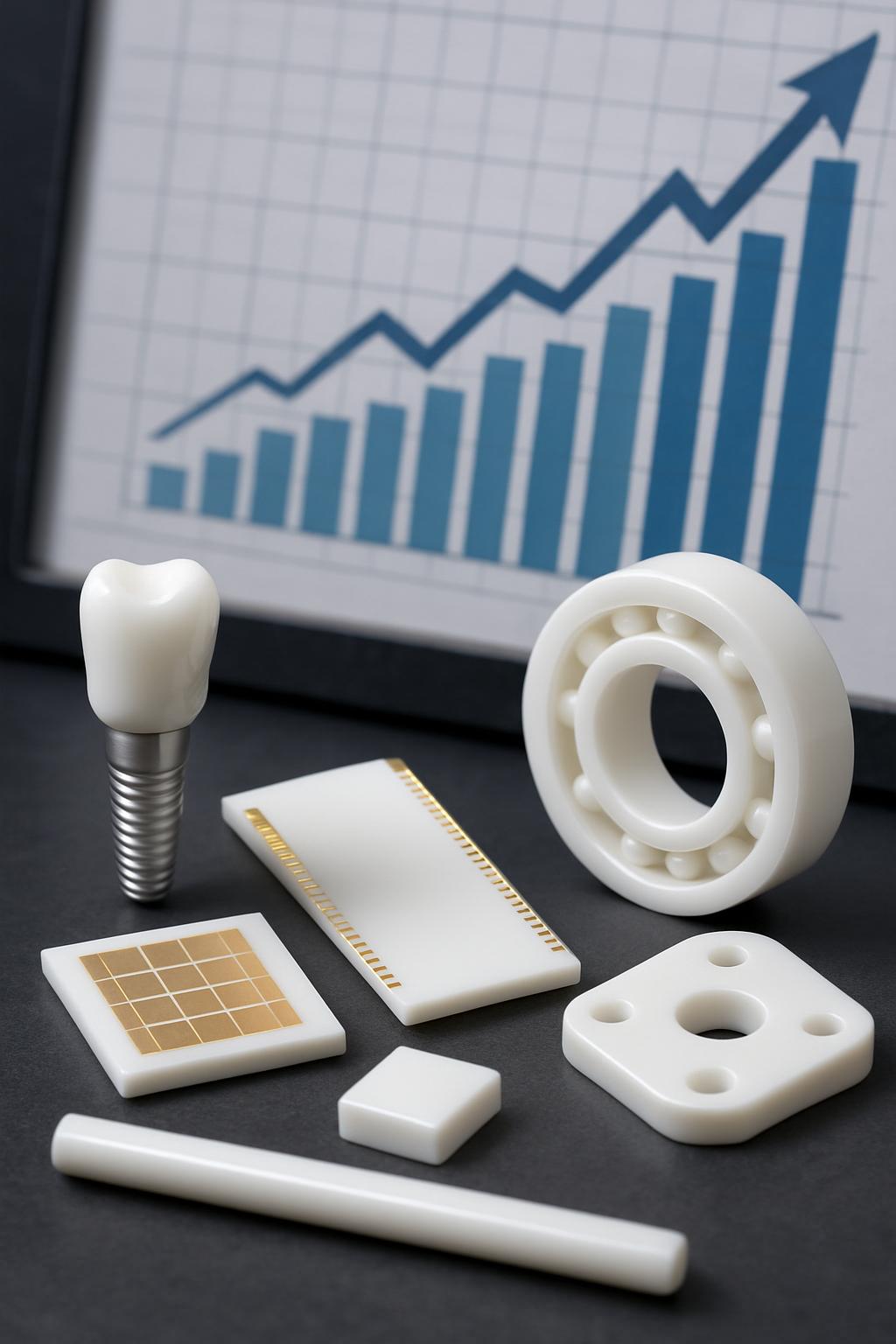

Figure 1: Global Zirconia Market Growth Trend and Application Products

Market Size

Looking at the data, the global zirconia market reached approximately $5.23 billion in 2023 and is projected to grow to $8.78 billion by 2030, representing a compound annual growth rate (CAGR) of about 7.6%. This growth rate significantly exceeds that of many other industrial materials markets according to Grand View Research.

| Year | Market Size ($ Billion) | YoY Growth (%) |

|---|---|---|

| 2023 | 5.23 | 6.5 |

| 2024 | 5.61 | 7.3 |

| 2025 | 6.04 | 7.7 |

| 2026 | 6.51 | 7.8 |

| 2027 | 7.02 | 7.8 |

| 2028 | 7.57 | 7.8 |

| 2029 | 8.15 | 7.7 |

| 2030 | 8.78 | 7.7 |

From a regional perspective, Asia-Pacific holds the largest zirconia market share (approximately 45%), followed by North America (25%) and Europe (20%). China, Japan, and the United States are the largest single-country markets. India and Southeast Asian countries are experiencing the fastest growth in the zirconia sector, with CAGRs expected to reach 9-11% between 2025 and 2030.

The zirconia market growth is driven by industrial modernization in emerging economies, technological advances reducing production costs, and increased demand for environmentally friendly materials. Analysts believe the zirconia market will maintain robust growth, with main growth points concentrated in Asia-Pacific, especially China and India.

Stabilized zirconia (such as yttria-stabilized zirconia, YSZ) dominates the market, accounting for approximately 65% of total demand. Partially stabilized zirconia (PSZ) and tetragonal zirconia polycrystal (TZP) hold significant market shares at 20% and 15%, respectively.

Major production processes include fusion, hydrothermal, and sol-gel methods. Recent advances in nano-scale powder preparation have substantially improved product performance while reducing environmental impact.

Medical Use

Surging demand in the medical industry, particularly in dental and orthopedic fields, has become one of the main drivers of market growth. Zirconia applications in the medical field primarily focus on the following areas:

Figure 2: Zirconia Dental Implants and Restorative Material Applications

| Application Area | Market Share (%) | Expected Annual Growth (%) | Main Driving Factors |

|---|---|---|---|

| Dental Restoration | 38 | 8.5 | Aesthetic demands, biocompatibility |

| Orthopedic Implants | 27 | 9.2 | Aging population, increased sports injuries |

| Medical Device Components | 21 | 7.8 | Precision medical device popularization |

| Diagnostic Equipment | 14 | 6.5 | Medical technology advancement |

The global aging trend, with the population aged 65+ expected to increase by approximately 350 million by 2030, will directly drive demand for dental restorations and orthopedic implants. Simultaneously, improvements in medical infrastructure in emerging markets will create broader market space for advanced ceramic applications.

In the dental field, these ceramic materials have become the primary alternative to metal-ceramic restorations, offering better biocompatibility, more natural aesthetics, and higher strength. Globally, approximately 15 million dental restorations use zirconia materials annually, expected to increase to 28 million by 2030.

Growth in the zirconia sector is also driven by advances in digital dental technology. Computer-aided design and manufacturing (CAD/CAM) technology has made the production of customized restorations more efficient and precise.

In orthopedics, these advanced ceramics are primarily used in hip and knee replacement surgeries for joint balls and liners, offering lower wear rates and longer service life compared to traditional materials.

Quality standards for medical-grade products continue to improve, with strict requirements from regulatory bodies like the FDA and European MDR. The competitive landscape is relatively concentrated, with the top five global suppliers accounting for approximately 60% of market share.

Electronics

Transformation in the electronics industry is creating new demand for high-performance ceramic materials. With accelerated 5G network deployment and IoT device proliferation, demand for high-frequency electronic components has surged.

| Electronic Application | 2023 Market Size ($ Million) | 2030 Forecast ($ Million) | CAGR (%) |

|---|---|---|---|

| 5G/6G Components | 420 | 980 | 12.8 |

| Semiconductor Equipment | 380 | 820 | 11.6 |

| Sensor Materials | 290 | 650 | 12.2 |

| Electronic Packaging | 210 | 410 | 10.0 |

Demand for ultra-high-purity zirconia in semiconductor manufacturing equipment is particularly prominent as chip manufacturing processes advance toward 3nm and even 2nm nodes. Its excellent performance in high-temperature and corrosive environments makes it indispensable in this field.

In 5G and future 6G communication technologies, zirconia ceramics are widely used in high-frequency filters, resonators, and antenna components, offering lower dielectric loss and higher frequency stability than traditional materials.

Applications of zirconia in electronic packaging are also increasing as electronic devices trend toward miniaturization and high performance. Zirconia-based composite materials with good thermal properties have become ideal choices for advanced packaging technologies.

Zirconia-based oxygen sensors are widely used in automotive exhaust monitoring, industrial process control, and environmental monitoring. With increasingly stringent environmental regulations and IoT technology popularization, demand for high-performance sensors continues to grow.

Technical requirements for electronic-grade zirconia are increasing, with purity requirements rising from 99.9% to 99.999% or higher, and particle size control precision improving from micron to nanometer levels.

Green Tech

Increasingly stringent environmental regulations are driving the expansion of applications in environmental fields. Rising industrial emission standards worldwide have generated demand for high-efficiency catalytic materials according to the International Energy Agency.

Figure 3: Zirconia Applications in Renewable Energy Systems

Major environmental applications of zirconia include:

- Automotive exhaust catalytic converters

- Industrial waste gas treatment systems

- Water treatment and purification equipment

- Renewable energy system components

| Environmental Application | Market Share (%) | Growth Potential | Main Driving Policies |

|---|---|---|---|

| Automotive Catalysts | 42 | High | Euro VII/China National 6 emission standards |

| Industrial Waste Gas Treatment | 28 | Medium-High | Carbon neutrality policies, Clean Air Acts |

| Water Treatment Systems | 18 | Medium | Drinking water safety standard improvements |

| Renewable Energy | 12 | Very High | Green energy transition policies |

Particularly noteworthy is the application in solid oxide fuel cells (SOFC). With the global advancement of hydrogen energy strategies, the SOFC market is expected to expand at an annual growth rate exceeding 20%.

In automotive exhaust treatment systems, zirconia-based oxygen sensors and catalyst carriers have become standard configurations. Major automotive markets continuously raise emission standards, driving demand for high-performance materials.

In industrial waste gas treatment, these advanced catalysts perform excellently in harsh environments. With carbon neutrality goals being implemented worldwide, industrial enterprises face increasingly stringent emission restrictions.

In water treatment, ceramic-based membrane materials and adsorbents remove heavy metals, organic pollutants, and microorganisms from water, offering higher selectivity and longer service life than traditional materials.

The renewable energy field represents one of the most promising application areas for zirconia. In solid oxide fuel cells, these electrolytes efficiently conduct oxygen ions at high temperatures. In solar thermal power generation systems, ceramic-based thermal barrier coatings increase collector efficiency.

Tech Gains

Continuous technological breakthroughs are opening new application fields for advanced ceramics. Advances in nano-scale material preparation have substantially improved material performance while reducing production costs.

| Technological Innovation | Market Impact | Expected Commercialization Time | Potential Application Fields |

|---|---|---|---|

| Nano-Ceramics | High | Already commercialized | Catalysts, coatings, biomedicine |

| 3D-Printed Ceramics | Very High | 2023-2025 | Medical implants, precision industrial parts |

| Functionally Graded Materials | Medium-High | 2025-2027 | Aerospace, extreme environment applications |

| Composite Ceramics | Medium | Already commercialized | Structural components, wear-resistant applications |

| Transparent Ceramics | Medium-High | 2024-2026 | Optical elements, high-end consumer goods |

Additive manufacturing (3D printing) technology has made the manufacturing of complex-shaped zirconia components possible, with revolutionary significance in medical implants and high-performance industrial components. By 2030, the market for 3D-printed zirconia components is expected to grow from approximately $180 million in 2023 to $750 million, representing a CAGR of 22.6%.

Functionally graded materials (FGM) technology addresses limitations of traditional ceramic materials in thermal stress management and interface bonding, expanding market space in aerospace and extreme environment applications.

Nano-scale zirconia materials significantly improve strength, toughness, and stability through controlled grain size and distribution. While production costs remain relatively high, they are expected to decrease with technological progress and scale production.

Transparent ceramic products represent another innovation hotspot. By controlling grain size and porosity, high-transparency zirconia ceramics can be prepared for optical elements and high-end consumer goods applications.

Materials science research continues to drive innovation in the zirconia field, with hundreds of research papers and dozens of patents annually providing technical support for long-term market growth.

Supply Web

The supply landscape is being reshaped by changes in global zirconium resource distribution and production patterns. Australia, South Africa, and China are the main global zirconium resource countries, but the zirconia supply landscape has been changing significantly according to the Zircon Industry Association.

| Country/Region | Zirconium Resource Reserve Share (%) | Production Capacity Share (%) | Capacity Growth Trend |

|---|---|---|---|

| China | 8 | 45 | Steady growth |

| Australia | 32 | 18 | Slow decline |

| South Africa | 21 | 12 | Basically stable |

| Other Asia | 15 | 15 | Rapid growth |

| Other Regions | 24 | 10 | Slight growth |

Geopolitical factors and trade policy changes are affecting the global zirconia supply chain. Chinese enterprises are accelerating their transition toward high-end products, while Australia and Western countries focus more on supply chain security and critical material self-sufficiency.

Australia possesses the world’s largest zircon sand reserves (32% of global total), but its zirconia production capacity share is only 18% and declining due to rising production costs and environmental requirements.

China has become the world’s largest producer with a 45% production capacity share despite limited zirconium resources, leveraging its complete industrial chain and cost advantages. By 2030, China’s share in the high-end zirconia market is expected to increase significantly.

Southeast Asian countries, particularly Vietnam, Indonesia, and Malaysia, are emerging as new production bases, attracting substantial investment through relatively low labor costs and relaxed environmental policies.

Raw material price fluctuations significantly impact the market. Zircon sand prices have fluctuated considerably over the past five years, rising from $1,000 per ton in 2018 to $2,500 per ton in 2021, subsequently falling back to $1,800-2,000 per ton in 2022-2023.

Supply chain sustainability is increasingly becoming an industry focus, with mine environmental impact, energy consumption, and carbon emissions becoming important evaluation indicators for the zirconia industry.

New Uses

Emerging applications continue to appear, creating incremental space for the zirconia market. Beyond traditional applications, the following emerging fields will become important drivers of future growth:

| Emerging Application Field | Expected Market Size (2030) | Annual Growth Rate (%) | Market Maturity |

|---|---|---|---|

| Aerospace Materials | $580 million | 14.2 | Developing |

| Wearable Device Components | $320 million | 18.5 | Early stage |

| Hydrogen Energy Infrastructure | $750 million | 22.3 | Early stage |

| High-End Consumer Goods | $280 million | 12.7 | Mature |

| Advanced Sensors | $410 million | 16.8 | Developing |

The aerospace field’s demand for ultra-high-temperature materials continues to increase, with zirconia-based composite materials having broad application prospects in engine components and thermal protection systems.

Demand for scratch-resistant, high-strength casing materials in wearable and smart devices has created a new consumer electronics application market for zirconia products.

Accelerated hydrogen energy infrastructure construction will significantly expand zirconia applications in electrolyzers, hydrogen storage systems, and fuel cells.

Applications of zirconia for decorative purposes in luxury goods and high-end consumer products are also increasing, particularly in high-end watches, jewelry, and consumer electronics appearance components.

Advanced sensors represent another important application field, with zirconia-based sensors exhibiting excellent stability and reliability in harsh environments.

Cross-industry applications are expanding as materials science and manufacturing technology advance, creating new growth opportunities for zirconia across energy, transportation, construction, biomedicine, and environmental protection fields.

FAQ Section

Q1: What is the difference between zirconia and zirconium dioxide?

Zirconia (ZrO₂) and zirconium dioxide refer to the same compound, with different terminology used across industries. Scientific literature typically uses “zirconium dioxide,” while “zirconia” is more common in commercial contexts. Market segmentation primarily occurs by stabilization type (such as yttria-stabilized, magnesia-stabilized) and purity grade, rather than by name itself.

Stabilized zirconia prevents phase transformation by adding stabilizers to maintain specific crystal structures, improving high-temperature stability. Different stabilized types have different performance characteristics suitable for various applications.

Q2: What role does China play in the global zirconia market?

China is currently the world’s largest producer and consumer, accounting for approximately 45% of global production capacity and 38% of consumption. China is transitioning from a low-end product supplier to a full industrial chain participant, with rapidly growing investment in high-purity and specialty fields.

By 2030, China is expected to further consolidate its market leadership, with high-end zirconia product market share projected to grow from the current approximately 25% to 35-40%. Chinese enterprises are enhancing competitiveness through technological innovation, industrial integration, and international cooperation, supported by favorable government industrial policies.

Q3: What emerging applications exist in renewable energy?

Applications of zirconia in renewable energy are rapidly expanding, primarily including: electrolyte materials in solid oxide fuel cells; high-temperature electrolyzer components in hydrogen production; thermal barrier coatings in solar thermal power generation; high-performance bearings in wind power generators; and specialty ceramic separators in energy storage systems.

In solid oxide fuel cells, zirconia electrolytes efficiently conduct oxygen ions at high temperatures. With hydrogen energy strategies advancing, the SOFC market is expected to expand at an annual growth rate exceeding 20%.

In solar thermal power generation, ceramic-based thermal barrier coatings increase collector efficiency. In wind power generators, ceramic-based bearings offer longer service life and higher reliability, particularly for offshore applications.

Q4: What are the main challenges facing the zirconia market?

Main challenges include: high production costs, particularly for high-purity products; processing difficulties limiting complex-shaped component manufacturing; low-temperature brittleness issues; raw material supply fluctuations; and insufficient market standardization.

From a commercial perspective, the market is highly fragmented and competitive, with small and medium-sized enterprises facing integration pressure. Competition from alternative materials in certain application fields is also intensifying.

Reducing production costs and improving processing technologies are key industry R&D directions. Developing ceramic materials with both high strength and high toughness remains a significant technical challenge.

Q5: Which segments of the value chain should investors focus on?

Investors should particularly focus on high-growth-potential segments: medical-grade zirconia, especially customized dental and orthopedic implants; electronic-grade ultra-high-purity powders; nano-scale materials; ceramic-based solid oxide fuel cell components; and additive manufacturing materials.

The medical-grade zirconia market is driven by global aging trends and medical technology advances, with expected annual growth rates of 12-15%. The electronic-grade ultra-high-purity powder market is driven by semiconductor and 5G/6G communication technology development, with expected annual growth rates of 16-20%.

Nano-scale ceramic materials have broad applications ranging from catalysts to biomedicine, with expected annual growth rates of 14-18%. The zirconia-based solid oxide fuel cell component market is driven by hydrogen energy strategies, with high expected annual growth rates of 20-25%.

Material recycling and circular utilization also represent emerging fields with long-term growth potential as environmental requirements increase and resource shortage issues intensify.