Ceramic components are no longer niche. In today’s electronics and medical sectors, they play a key role in devices that demand high frequency performance, extreme thermal stability, or full biocompatibility. But sourcing these parts is nothing like buying commodity hardware.

For procurement leaders handling ceramic components, the stakes are high. You’re not just ordering parts—you’re sourcing performance. Mistakes at this stage can delay product launches, breach medical compliance, or cause signal failure in 5G base stations.

This guide provides clear, actionable sourcing advice for ceramic components used in advanced applications. Whether you’re managing global sourcing or specifying for a prototype line, this article will help you align technical, supply chain, and commercial priorities.

Why Advanced Ceramics Matter in 5G and Medical Tech

Here’s what you need to know: In 5G infrastructure, ceramic materials have become essential thanks to their precisely engineered dielectric constants, high Q factors, and unmatched stability under thermal cycling. These attributes allow them to serve as filters, resonators, circuit substrates, and antenna supports in high-frequency bands. As 5G moves past 3.5 GHz toward 6 GHz and millimeter-wave frequencies, these materials are even more critical.

In medical devices, ceramics shine for biocompatibility. Orthopedic implants, dental crowns, pacemaker housings, and ultrasonic transducers all rely on ceramic compositions to remain stable inside the human body. Unlike many metals, ceramic materials resist corrosion, do not trigger toxic reactions, and can be sterilized repeatedly without losing strength or shape.

Let’s break that down in a simple way:

- 5G Applications

- Stable dielectric constant supports GHz radio systems

- Low loss tangent ensures minimal energy loss

- High hardness tolerates micro-assembly and thin layers

- Medical Applications

- Biologically inert for implants and sensors

- Radiolucency (X-rays pass through) for imaging

- Extreme wear resistance in joint replacements

| Property | Benefit in 5G or Medical Devices |

|---|---|

| Low dielectric loss | Stable RF signal transmission |

| High mechanical strength | Device miniaturization without breakage |

| Corrosion resistance | Durability in body fluids or harsh settings |

| High thermal stability | Consistent performance across temperature |

| Biocompatibility | Safe for implantation and skin contact |

The main takeaway is simple: ceramic components do not just “fit” a spec sheet — they actively protect the entire performance envelope of the end product.cing performance consistency across frequencies, temperatures, and biological environments.

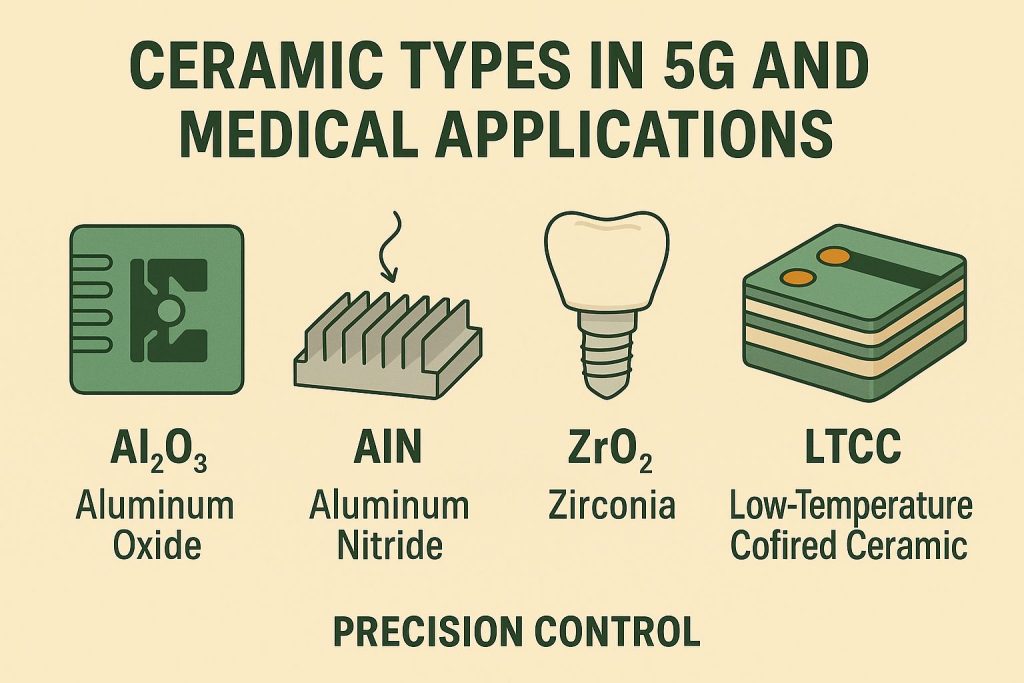

Types of Ceramics in Use

Ceramic is not one single material — it is a large family of engineered compounds, each chosen for different functions. Understanding these differences helps you, as a sourcing manager or technical lead, to match your product’s requirements to the best ceramic grade.

In industry, ceramics are classified by composition, microstructure, and end-use function. For sourcing, you should focus on composition and performance, since these factors determine supplier choice, pricing, and manufacturing constraints.

Below is a practical overview of high-tech ceramics:

📋 Common Ceramic Types and Applications

| Ceramic Type | Key Traits | Typical Applications |

|---|---|---|

| Alumina (Al₂O₃) | High hardness, thermal stability | Circuit substrates, structural insulators |

| Zirconia (ZrO₂) | Fracture toughness, biocompatibility | Dental implants, surgical tools, bearings |

| Barium Titanate | Ferroelectric, high dielectric constant | Capacitors, multilayer chip components |

| Silicon Nitride | Wear resistance, high strength | Turbocharger rotors, orthopedic implants |

| Steatite | Low dielectric loss, low cost | Heater bodies, basic RF insulators |

| Mullite | Excellent thermal shock resistance | Kiln furniture, heat-resistant substrates |

| Cordierite | Low thermal expansion | Automotive catalytic converter supports |

🔎 Selection Considerations

When you review technical specifications or supplier proposals, pay attention to:

- Grain size (influences machining and surface finish)

- Porosity (low porosity supports high dielectric strength)

- Impurity content (critical for medical-grade zirconia or high-Q RF ceramics)

- Sintering process (affects shrinkage and tolerances)

- Availability of standard shapes (lowers mold or tooling costs)

For example, a medical implant developer may specify zirconia for toughness and bio-safety, while a 5G RF filter engineer often leans toward barium titanate or alumina for their stable high-frequency behavior.

Remember, one ceramic type cannot suit every need. Investing the time to match application to ceramic family saves you costly redesigns and wasted prototypes down the line.

This visual helps buyers quickly distinguish between ceramic types during sourcing discussions.n reality, each formulation and process route requires specialized equipment and handling.

Challenges in Sourcing Ceramic Components

Sourcing advanced ceramics isn’t plug-and-play. You face multiple overlapping challenges across technical, supply chain, and commercial dimensions. Each dimension brings its own pain points — and ignoring them can mean costly delays, missed specifications, or regulatory risk.

Let’s break them down in detail:

► Technical Challenges

- Dimensional shrinkage: advanced ceramics shrink up to 20% during sintering, which demands extremely precise mold and tooling design.

- Complex geometry: internal channels or thin walls can warp or crack if the firing profile isn’t perfectly matched to the ceramic formulation.

- Post-processing needs: many advanced ceramics require grinding, polishing, or even laser patterning to meet functional tolerances.

- Metallization: when a ceramic needs to be soldered or bonded to metal, it often requires a carefully formulated metallized layer. Not every supplier can guarantee consistent adhesion or electrical performance.

🚚 Supply Chain Challenges

- Limited supplier base: compared to plastics or metals, there are far fewer global players with proven high-reliability ceramic capacity.

- Long lead times: ceramics need multiple sintering and inspection stages, adding weeks to any order cycle.

- Batch variability: the slightest raw material shift — even from the same mine — can change shrinkage or dielectric values, creating serious downstream issues.

- Inventory risk: high minimum order quantities can tie up working capital, especially on prototype programs.

💸 Commercial Risks

- Price volatility: raw ceramic powders, especially high-purity alumina or yttria-stabilized zirconia, can swing in price depending on global mining and refining cycles.

- Qualification gaps: some new suppliers offer cheap pricing but can’t show proper data on shrinkage, biocompatibility, or mechanical consistency.

- Inconsistent documentation: without clear certificates, your products can get stuck during customs or third-party audits.

- After-sales support: many ceramic shops do not provide long-term warranty or failure analysis, making your quality claims harder to defend with end customers.

✅ Proactive Sourcing Checklist

A robust ceramic sourcing team usually covers these points:

- Confirm the supplier’s experience with similar applications (medical or 5G, not just generic ceramics)

- Request batch-specific shrinkage data and test coupons

- Review raw material origin with certificates

- Verify that a supplier can deliver metallization or post-processing in-house to reduce subcontracting risk

- Add a second-source plan in case the main vendor fails during ramp-up

Real-world reminder: one B2B team in telecom sourced multilayer ceramic resonators from a new offshore supplier without verifying sintering tolerances. The result? Over 30% of parts failed RF performance testing due to permittivity drift, and a product launch was delayed three months. After switching to a vendor with tighter sintering profile control, they restored schedule and cut failure rates to under 3% in the next cycle.

Selecting the Right Supplier: What to Prioritize

Not all ceramic suppliers are created equal. For high-reliability applications like 5G filters or implantable housings, your vendor must do more than ship parts—they must understand the end-use function and offer material traceability.

📌 Evaluation Criteria for Ceramic Suppliers

| Factor | What to Ask | Why It Matters |

|---|---|---|

| Application knowledge | “Have you supplied for 5G filters?” | Lowers prototyping risk |

| Material purity | “Can you provide 99.5% alumina cert?” | Ensures electrical performance |

| Sintering control | “Do you use isostatic pressing?” | Impacts shrinkage & strength |

| Traceability | “Is there full batch tracking?” | Critical for medical compliance |

| Response time | “Can you quote in <48 hrs?” | Indicates professionalism |

One example: A sourcing team in Germany replaced a low-cost zirconia supplier after finding inconsistent shrinkage and poor lot-to-lot performance. Their second supplier offered not only tighter tolerances but also on-site metallization—reducing post-processing steps and improving device yield by 22%.

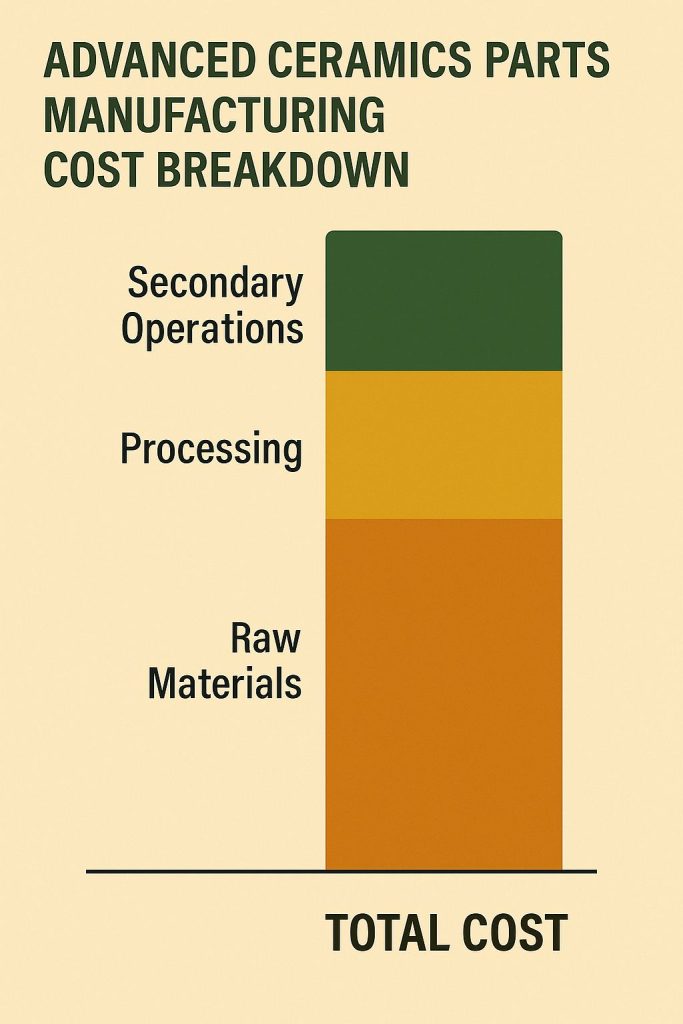

Cost Drivers in Ceramic Sourcing

Let’s get practical: ceramic components often appear expensive at first glance. But understanding the true cost drivers will help you negotiate smarter and forecast project budgets more reliably.

Here’s what shapes ceramic pricing:

- Raw materials (e.g., alumina, zirconia, rare-earth dopants)

- Tooling and custom molds (often high one-time setup cost)

- Batch sizes (many suppliers need minimum order quantities for kiln utilization)

- Secondary operations (grinding, polishing, metallization, laser drilling)

- Quality testing and certification (FDA, ISO, dielectric testing)

Cost breakdown illustration:

| Cost Element | Approx. % of Unit Price |

|---|---|

| Raw materials | 15–25% |

| Shaping + sintering | 30–45% |

| Secondary processing | 20–30% |

| Certification & testing | 5–10% |

| Logistics & admin | 5–10% |

This infographic visualizes how raw material, processing, secondary steps, and quality testing contribute to the total ceramic unit cost.

When reviewing quotes, ask for itemized pricing so you can see if any line is inflated. Many B2B teams forget that one-time tooling charges can be amortized across several projects, which may lower unit costs in the second or third production cycle.

Navigating Compliance and Standards

For medical and telecom buyers, compliance is more than a checkbox—it’s a survival requirement. Regulatory errors with ceramic parts can derail certification or product launch.

📋 Core Standards to Know

- ISO 13485 for medical devices

- FDA Class II/III for implants or transducers

- RoHS/REACH for European electronics

- IEC standards on dielectric performance

A good ceramic supplier should proactively document:

- Material origin

- Batch traceability

- Biocompatibility data (if medical)

- Dielectric testing (if RF)

Pro tip: have your supplier keep certificates on a secure, shareable portal to speed up your audits.

🏥 Typical Compliance Challenges

| Challenge | Impact |

|---|---|

| Missing lot data | Blocked approvals |

| Poor surface contamination control | Implant rejection risk |

| No dielectric test documentation | RF performance uncertainty |

| Weak RoHS declarations | Customs clearance delays |

A supplier who cannot show these documents should raise a red flag. In high-reliability ceramic sourcing, compliance equals confidence.

Strategies for Reducing Lead Time

Lead times are a top complaint for advanced ceramics. Sintering and post-processing simply take time, sometimes weeks per cycle. However, smart planning can cut waiting dramatically.

Here are actionable strategies to cut lead time:

- Use standard sizes wherever possible

- Pre-book kiln slots with your supplier

- Consolidate orders to build priority status

- Approve samples quickly so production is not held up

- Share forecasts to help your supplier align raw material purchases

📊 Typical Ceramic Lead Times

| Stage | Duration (Typical) |

|---|---|

| Tooling + mold setup | 3–6 weeks |

| Sintering cycle | 5–10 days |

| Secondary processing | 7–14 days |

| Testing + certification | 5–10 days |

This timeline graphic shows the stages from design approval through tooling, sintering, testing, and final shipment for advanced ceramic parts.

Total cycle = ~8–12 weeks from order to delivery if starting from scratch. Having a well-managed forecast can cut this in half over time.

Case Study: Ceramic Filter Procurement for 5G Base Stations

Let’s see this in action.

A Tier 1 telecom supplier needed high-frequency ceramic filters for 5G macro base stations. Their challenge? Local vendors could not meet a tight 0.2% permittivity tolerance, causing signal dropouts.

Solution path:

- Switched to a supplier with high-pressure isostatic pressing

- Added batch traceability for permittivity

- Pre-approved test coupons to speed up first-article testing

- Consolidated annual volumes to lock priority production

Result:

They reduced rejection rates from 14% to below 2% in just two quarters, saving an estimated $300,000 in rework and improving their time-to-market by 4 weeks.

Supplier Management and Long-Term Partnerships

Look beyond one shipment: advanced ceramic sourcing is rarely a one-off deal. Since consistency matters across batches, cultivating a stable supplier relationship is your best defense against quality or compliance drift.

Here’s what builds great long-term partnerships:

- Joint quality audits twice a year

- Regular material certification updates

- Agreed-upon cost review windows

- Emergency production slots for urgent orders

- Collaborative R&D on new ceramic grades

Some buyers set up a supplier scorecard to track:

- On-time delivery rate

- Non-conformance rates

- Responsiveness

- Certification consistency

By sharing these results openly, you motivate suppliers to maintain excellence without constant firefighting.

🏆 Supplier Partnership Checklist

| Partnership Element | Why It Matters |

|---|---|

| Scheduled audits | Keeps quality on track |

| Cost renegotiation window | Allows mutual adjustments |

| Emergency slots | Guarantees flexibility for projects |

| Collaborative R&D | Adapts to emerging requirements |

Final Takeaways for Ceramic Sourcing in High-Tech Markets

Sourcing ceramic components for 5G and medical applications is challenging — but absolutely manageable with the right playbook. Let’s recap the key points:

- Ceramics matter: Their physical, dielectric, and biocompatibility traits are essential to next-gen devices

- Supplier choice is crucial: It affects shrinkage, traceability, certifications, and response time

- Cost drivers are predictable: Raw materials, tooling, and batch volume all influence unit price

- Compliance cannot fail: Missing documents will block your project approvals

- Lead times can be improved: Through forecasts, standard parts, and early approvals

- Long-term partnerships: Strengthen quality, lower stress, and boost resilience

👉 By understanding these layers, you build a ceramic sourcing program that is stable, flexible, and ready for innovation — in 5G, medical, and beyond.

Conclusion

Sourcing advanced ceramic components means balancing engineering goals, market regulations, and supply chain constraints. This is no small task — especially when your parts must perform under tight tolerances and in critical applications.

Yet with careful supplier selection, a thorough compliance framework, and a willingness to collaborate over the long term, your team can transform ceramic sourcing from a risk to a strategic advantage.

Global Industry is here to help you. Our expertise in ceramic sourcing, manufacturing partnerships, and material qualification can guide you through each stage. If you’d like to explore a tailored sourcing strategy for your 5G or medical projects, reach out today — let’s build the future together.

FAQ Section

Q1: Why are ceramics used in 5G infrastructure?

Ceramics offer stable dielectric properties at GHz frequencies, which supports precise signal transmission through filters and antenna elements. Their high mechanical strength and thermal stability help maintain performance even in harsh outdoor telecom conditions. In addition, ceramics are resistant to corrosion, so they last longer than many polymer alternatives in 5G base station environments.

Q2: What is the biggest challenge in ceramic sourcing?

One major challenge is controlling shrinkage during sintering so the final component meets tight tolerances. Many sourcing teams also struggle to find suppliers that understand high-spec telecom or medical requirements and can deliver traceable, certified ceramic batches. The specialized tooling and long lead times further complicate planning and supplier onboarding.

Q3: How can I reduce the cost of ceramic parts?

You can reduce costs by consolidating orders to improve your supplier’s efficiency and lower per-part pricing. Another strategy is to standardize your designs around existing ceramic tooling, which minimizes setup costs. Partnering with your supplier early in the design stage often uncovers cost-saving adjustments in geometry, tolerances, or material choice.

Q4: Which certifications should I check for medical ceramics?

Medical-grade ceramic components should comply with ISO 13485, plus hold appropriate FDA class II or class III clearances depending on the device. You should also verify that the ceramic has documented biocompatibility and chemical stability data. In some regions, additional local certifications (such as CE marking in Europe) will apply, and should be confirmed before production begins.

Q5: How long does ceramic sourcing usually take?

Typical ceramic sourcing takes 8–12 weeks from the first drawings to approved final parts, depending on complexity. This includes mold or tooling fabrication, sintering cycles, secondary processing, and quality testing. If you are working with a new supplier, allow extra time for first-article qualification and potential design iterations before mass production begins.